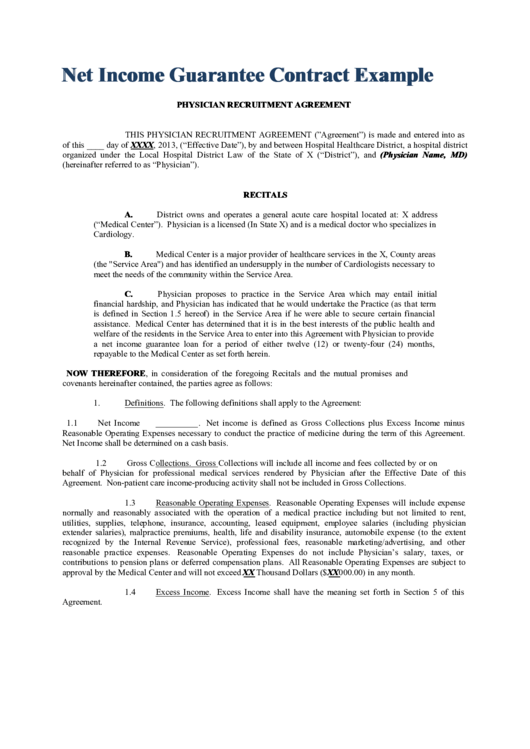

Net Income Guarantee Contract Example

ADVERTISEMENT

Net Income Guarantee Contract Example

PHYSICIAN RECRUITMENT AGREEMENT

THIS PHYSICIAN RECRUITMENT AGREEMENT (”Agreement”) is made and entered into as

of this ____ day of XXXX, 2013, (“Effective Date”), by and between Hospital Healthcare District, a hospital district

organized under the Local Hospital District Law of the State of X (“District”), and (Physician Name, MD)

(hereinafter referred to as “Physician”).

RECITALS

A.

District owns and operates a general acute care hospital located at: X address

(“Medical Center”). Physician is a licensed (In State X) and is a medical doctor who specializes in

Cardiology.

B.

Medical Center is a major provider of healthcare services in the X, County areas

(the "Service Area") and has identified an undersupply in the number of Cardiologists necessary to

meet the needs of the community within the Service Area.

C.

Physician proposes to practice in the Service Area which may entail initial

financial hardship, and Physician has indicated that he would undertake the Practice (as that term

is defined in Section 1.5 hereof) in the Service Area if he were able to secure certain financial

assistance. Medical Center has determined that it is in the best interests of the public health and

welfare of the residents in the Service Area to enter into this Agreement with Physician to provide

a net income guarantee loan for a period of either twelve (12) or twenty-four (24) months,

repayable to the Medical Center as set forth herein.

NOW THEREFORE, in consideration of the foregoing Recitals and the mutual promises and

covenants hereinafter contained, the parties agree as follows:

1.

Definitions. The following definitions shall apply to the Agreement:

1.1

Net Income. Net income is defined as Gross Collections plus Excess Income minus

Reasonable Operating Expenses necessary to conduct the practice of medicine during the term of this Agreement.

Net Income shall be determined on a cash basis.

1.2

Gross Collections. Gross Collections will include all income and fees collected by or on

behalf of Physician for professional medical services rendered by Physician after the Effective Date of this

Agreement. Non-patient care income-producing activity shall not be included in Gross Collections.

1.3

Reasonable Operating Expenses. Reasonable Operating Expenses will include expense

normally and reasonably associated with the operation of a medical practice including but not limited to rent,

utilities, supplies, telephone, insurance, accounting, leased equipment, employee salaries (including physician

extender salaries), malpractice premiums, health, life and disability insurance, automobile expense (to the extent

recognized by the Internal Revenue Service), professional fees, reasonable marketing/advertising, and other

reasonable practice expenses.

Reasonable Operating Expenses do not include Physician’s salary, taxes, or

contributions to pension plans or deferred compensation plans. All Reasonable Operating Expenses are subject to

approval by the Medical Center and will not exceed XX Thousand Dollars ($XX000.00) in any month.

1.4

Excess Income. Excess Income shall have the meaning set forth in Section 5 of this

Agreement.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11