Indiana Property Tax Benefits Form

ADVERTISEMENT

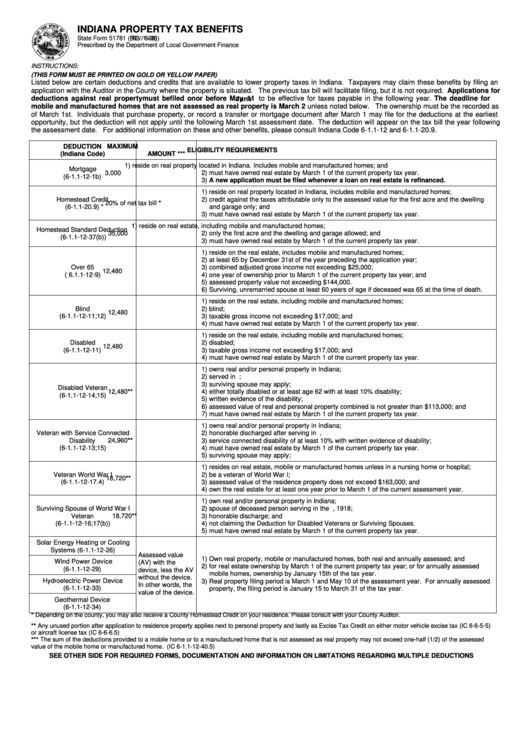

INDIANA PROPERTY TAX BENEFITS

(R3 / 5-06)

State Form 51781 (R2 / 1-06)

Prescribed by the Department of Local Government Finance

INSTRUCTIONS:

(THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER)

Listed below are certain deductions and credits that are available to lower property taxes in Indiana. Taxpayers may claim these benefits by filing an

application with the Auditor in the County where the property is situated. The previous tax bill will facilitate filing, but it is not required. Applications for

June

deductions against real property must be filed on or before May 11 to be effective for taxes payable in the following year. The deadline for

mobile and manufactured homes that are not assessed as real property is March 2 unless noted below. The ownership must be the recorded as

of March 1st. Individuals that purchase property, or record a transfer or mortgage document after March 1 may file for the deductions at the earliest

opportunity, but the deduction will not apply until the following March 1st assessment date. The deduction will appear on the tax bill the year following

the assessment date. For additional information on these and other benefits, please consult Indiana Code 6-1.1-12 and 6-1.1-20.9.

DEDUCTION

MAXIMUM

ELIGIBILITY REQUIREMENTS

(Indiana Code)

AMOUNT ***

1) reside on real property located in Indiana. Includes mobile and manufactured homes; and

Mortgage

3,000

2) must have owned real estate by March 1 of the current property tax year.

(6-1.1-12-1b)

3) A new application must be filed whenever a loan on real estate is refinanced.

1) reside on real property located in Indiana, includes mobile and manufactured homes;

Homestead Credit

2) credit against the taxes attributable only to the assessed value for the first acre and the dwelling

20% of net tax bill *

(6-1.1-20.9) *

and garage only; and

3) must have owned real estate by March 1 of the current property tax year.

1) reside on real estate, including mobile and manufactured homes;

Homestead Standard Deduction

35,000

2) only the first acre and the dwelling and garage allowed; and

(6-1.1-12-37(b))

3) must have owned real estate by March 1 of the current property tax year.

1) reside on the real estate, includes mobile and manufactured homes;

2) at least 65 by December 31st of the year preceding the application year;

Over 65

3) combined adjusted gross income not exceeding $25,000;

12,480

( 6.1.1-12-9)

4) one year of ownership prior to March 1 of the current property tax year; and

5) assessed property value not exceeding $144,000.

6) Surviving, unremarried spouse at least 60 years of age if deceased was 65 at the time of death.

1) reside on the real estate, including mobile and manufactured homes;

Blind

2) blind;

12,480

(6-1.1-12-11;12)

3) taxable gross income not exceeding $17,000; and

4) must have owned real estate by March 1 of the current property tax year.

1) reside on the real estate, including mobile and manufactured homes;

Disabled

2) disabled;

12,480

(6-1.1-12-11)

3) taxable gross income not exceeding $17,000; and

4) must have owned real estate by March 1 of the current property tax year.

1) owns real and/or personal property in Indiana;

2) served in U.S. military service for at least 90 days and honorably discharged;

3) surviving spouse may apply;

Disabled Veteran

12,480**

4) either totally disabled or at least age 62 with at least 10% disability;

(6-1.1-12-14;15)

5) written evidence of the disability;

6) assessed value of real and personal property combined is not greater than $113,000; and

7) must have owned real estate by March 1 of the current property tax year.

1) owns real and/or personal property in Indiana;

Veteran with Service Connected

2) honorable discharged after serving in U.S. military during a war,

24,960**

Disability

3) service connected disability of at least 10% with written evidence of disability;

(6-1.1-12-13;15)

4) must have owned real estate by March 1 of the current property tax year.

5) surviving spouse may apply;

1) resides on real estate, mobile or manufactured homes unless in a nursing home or hospital;

Veteran World War I

2) be a veteran of World War I;

18,720**

(6-1.1-12-17.4)

3) assessed value of the residence property does not exceed $163,000; and

4) own the real estate for at least one year prior to March 1 of the current assessment year.

1) own real and/or personal property in Indiana;

Surviving Spouse of World War I

2) spouse of deceased person serving in the U.S. military before November 12, 1918;

Veteran

18,720**

3) honorable discharge; and

(6-1.1-12-16;17(b))

4) not claiming the Deduction for Disabled Veterans or Surviving Spouses.

5) must have owned real estate by March 1 of the current property tax year.

Solar Energy Heating or Cooling

Systems (6-1.1-12-26)

Assessed value

1) Own real property, mobile or manufactured homes, both real and annually assessed; and

Wind Power Device

(AV) with the

2) for real estate ownership by March 1 of the current property tax year; or for annually assessed

(6-1.1-12-29)

device, less the AV

mobile homes, ownership by January 15th of the tax year.

without the device.

Hydroelectric Power Device

3) Real property filing period is March 1 and May 10 of the assessment year. For annually assessed

In other words, the

(6-1.1-12-33)

property, the filing period is January 15 to March 31 of the tax year.

value of the device.

Geothermal Device

(6-1.1-12-34)

* Depending on the county, you may also receive a County Homestead Credit on your residence. Please consult with your County Auditor.

** Any unused portion after application to residence property applies next to personal property and lastly as Excise Tax Credit on either motor vehicle excise tax (IC 6-6-5-5)

or aircraft license tax (IC 6-6-6.5)

*** The sum of the deductions provided to a mobile home or to a manufactured home that is not assessed as real property may not exceed one-half (1/2) of the assessed

value of the mobile home or manufactured home. (IC 6-1.1-12-40.5)

SEE OTHER SIDE FOR REQUIRED FORMS, DOCUMENTATION AND INFORMATION ON LIMITATIONS REGARDING MULTIPLE DEDUCTIONS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2