Milliman Employee Guidelines: Tuition Assistance

ADVERTISEMENT

Employee Guidelines: Tuition Assistance, Conferences,

Training Programs, Certifications, Registration, and Licensures

Purpose of Guideline: Milliman Care Guidelines (MCG) realizes that the future success and long-term growth of our

Company depend in part on the development of our employees. Therefore, MCG makes a commitment to provide

financial assistance to those employees wishing to increase their education and knowledge base through training

opportunities that benefit both the employee and the Company.

In addition to our Tuition Assistance Program, MCG offers educational and development programs to be attended on a

voluntary basis. These voluntary training programs are designed to benefit employees in their present jobs and to provide

assistance in increasing their knowledge base and span of responsibility.

Tuition Assistance

This program provides competitive and liberal coverage, and there are some limitations:

Eligible employees must be employed a minimum of 6 months with MCG and be in good standing.

o

The courses requested must directly or reasonably relate to the employee’s present position or be in line

o

with a position within Milliman, Inc. Under the program, educational assistance is provided for courses

offered by approved institutions of learning, such as accredited colleges, universities, and secretarial and

trade schools. This includes online courses.

Employees may be eligible to receive up to $7500 annually (January 1 through December 31). The date

o

that an employee receives approval determines which calendar year the tuition assistance funds will be

applied to. Each supervisor will be given an annual training budget to manage. Employees participating

in a MCG- sponsored Succession Plan are not subject to the limitations of the Tuition Assistance plan.

All requests are subject to pre-approval, and such approval will be based upon the above factors and

o

possible budgetary constraints.

Courses should not interfere with the employee’s current job responsibilities and must be taken on the employee’s own

time, outside of the employee’s normal working hours.

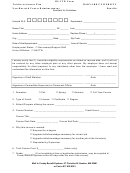

Employees will be asked to complete a Request for Tuition Assistance Form (attached to this policy) for each request and

deliver the completed form to their direct manager for approval. Employees must complete this procedure prior to

enrolling in the course.

Approved tuition assistance requests will cover tuition and reasonable expenses.

To receive reimbursement, the employee must:

Obtain a grade average of B or better (or evidence of satisfactory completion of the course when grades are not

•

given).

Submit to Accounts Payable copies of the pre-approved request form, evidence of satisfactory completion of the

•

course and all receipts.

Loans, direct payments, prepayments to schools, or advances cannot be made.

Due to the financial impact of the program, MCG reserves the right to change, modify, or cease the program at any time.

In the event the company changes the program, a good faith effort will be made to notify employees of the change.

Government tax law may require educational reimbursement as taxable income. Milliman Care Guidelines follows the

rules and rates established by the Internal Revenue Service.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2 3

3