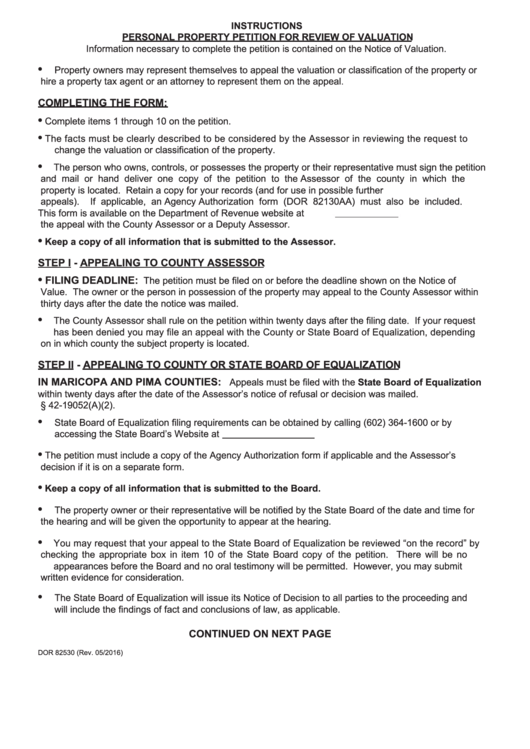

INSTRUCTIONS

PERSONAL PROPERTY PETITION FOR REVIEW OF VALUATION

Information necessary to complete the petition is contained on the Notice of Valuation.

•

Property owners may represent themselves to appeal the valuation or classification of the property or

hire a property tax agent or an attorney to represent them on the appeal.

COMPLETING THE FORM:

•

Complete items 1 through 10 on the petition.

•

The facts must be clearly described to be considered by the Assessor in reviewing the request to

change the valuation or classification of the property.

•

The person who owns, controls, or possesses the property or their representative must sign the petition

and mail or hand deliver one copy of the petition to the Assessor of the county in which the

property is located.

Retain a copy for your records (and for use in possible further

appeals).

If applicable, an Agency Authorization form (DOR 82130AA) must also be included.

This form is available on the Department of Revenue website at You may discuss

the appeal with the County Assessor or a Deputy Assessor.

•

Keep a copy of all information that is submitted to the Assessor.

STEP I - APPEALING TO COUNTY ASSESSOR

•

FILING DEADLINE:

The petition must be filed on or before the deadline shown on the Notice of

Value. The owner or the person in possession of the property may appeal to the County Assessor within

thirty days after the date the notice was mailed.

•

The County Assessor shall rule on the petition within twenty days after the filing date. If your request

has been denied you may file an appeal with the County or State Board of Equalization, depending

on in which county the subject property is located.

STEP II - APPEALING TO COUNTY OR STATE BOARD OF EQUALIZATION

IN MARICOPA AND PIMA COUNTIES:

Appeals must be filed with the State Board of Equalization

within twenty days after the date of the Assessor’s notice of refusal or decision was mailed.

A.R.S. § 42-19052(A)(2).

•

State Board of Equalization filing requirements can be obtained by calling (602) 364-1600 or by

accessing the State Board’s Website at

•

The petition must include a copy of the Agency Authorization form if applicable and the Assessor’s

decision if it is on a separate form.

•

Keep a copy of all information that is submitted to the Board.

•

The property owner or their representative will be notified by the State Board of the date and time for

the hearing and will be given the opportunity to appear at the hearing.

•

You may request that your appeal to the State Board of Equalization be reviewed “on the record” by

checking the appropriate box in item 10 of the State Board copy of the petition. There will be no

appearances before the Board and no oral testimony will be permitted. However, you may submit

written evidence for consideration.

•

The State Board of Equalization will issue its Notice of Decision to all parties to the proceeding and

will include the findings of fact and conclusions of law, as applicable.

CONTINUED ON NEXT PAGE

DOR 82530 (Rev. 05/2016)

1

1 2

2 3

3