Film Tax Credit

Download a blank fillable Film Tax Credit in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Film Tax Credit with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

PRINT

CLEAR

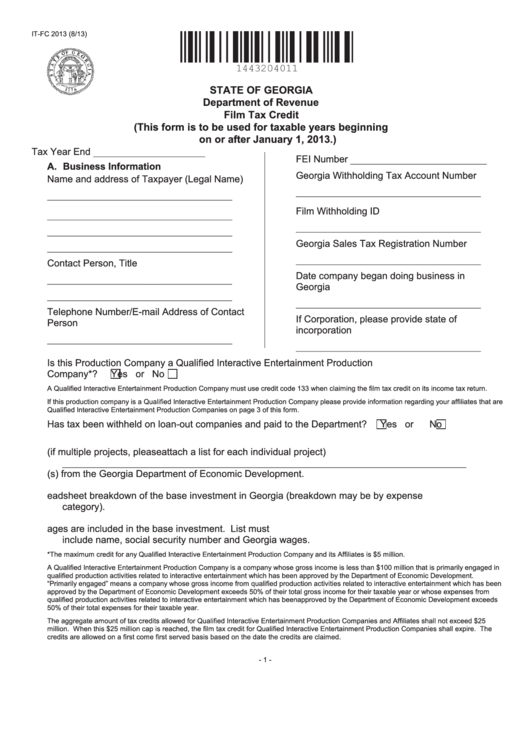

IT-FC 2013 (8/13)

STATE OF GEORGIA

Department of Revenue

Film Tax Credit

(This form is to be used for taxable years beginning

on or after January 1, 2013.)

Tax Year End _______________________

FEI Number ____________________________

A. Business Information

Georgia Withholding Tax Account Number

Name and address of Taxpayer (Legal Name)

______________________________________

______________________________________

Film Withholding ID

______________________________________

______________________________________

______________________________________

Georgia Sales Tax Registration Number

______________________________________

______________________________________

Contact Person, Title

Date company began doing business in

______________________________________

Georgia

______________________________________

______________________________________

Telephone Number/E-mail Address of Contact

If Corporation, please provide state of

Person

incorporation

______________________________________

______________________________________

Is this Production Company a Qualified Interactive Entertainment Production

Company*?

Yes or

No

A Qualified Interactive Entertainment Production Company must use credit code 133 when claiming the film tax credit on its income tax return.

If this production company is a Qualified Interactive Entertainment Production Company please provide information regarding your affiliates that are

Qualified Interactive Entertainment Production Companies on page 3 of this form.

Has tax been withheld on loan-out companies and paid to the Department?

Yes or

No

B. Project Information

1. Name of Project (if multiple projects, please attach a list for each individual project)

___________________________________________________________________________________

2. Attach a copy of the Certifications(s) from the Georgia Department of Economic Development.

3. Attach a spreadsheet breakdown of the base investment in Georgia (breakdown may be by expense

category).

4. Attach an employee listing for employees whose wages are included in the base investment. List must

include name, social security number and Georgia wages.

*The maximum credit for any Qualified Interactive Entertainment Production Company and its Affiliates is $5 million.

A Qualified Interactive Entertainment Production Company is a company whose gross income is less than $100 million that is primarily engaged in

qualified production activities related to interactive entertainment which has been approved by the Department of Economic Development.

“Primarily engaged” means a company whose gross income from qualified production activities related to interactive entertainment which has been

approved by the Department of Economic Development exceeds 50% of their total gross income for their taxable year or whose expenses from

qualified production activities related to interactive entertainment which has been approved by the Department of Economic Development exceeds

50% of their total expenses for their taxable year.

The aggregate amount of tax credits allowed for Qualified Interactive Entertainment Production Companies and Affiliates shall not exceed $25

million. When this $25 million cap is reached, the film tax credit for Qualified Interactive Entertainment Production Companies shall expire. The

credits are allowed on a first come first served basis based on the date the credits are claimed.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3