Film Tax Credit Page 2

Download a blank fillable Film Tax Credit in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Film Tax Credit with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

PRINT

CLEAR

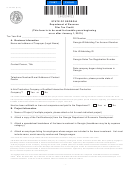

IT-FC 2013 (8/13)

Calculation of Credit

Current Tax Year

1. Credit on Base Investment or Excess Base Investment

(a) Base Investment/Excess Base Investment in Georgia _________________

(b) Percent of Credit for Base Investment

________20%______

(c) Tax Credit for Base Investment (multiply 1(a) by 1 (b))

_________________

2. Additional Credit for Qualified Georgia Promotion

(a) Base Investment/Excess Base Investment in Georgia _________________

(b) Percent of Credit for Qualified Georgia Promotion

________10%______

(c) Tax Credit for Qualified Georgia Promotion (multiply 2(a) by 2(b))

_________________

(d) Total Current Year Tax Credit (Add lines 1(c) and 2(c))

_________________

If this Production Company is a Qualified Interactive Production Company, then you must use

credit code 133 when claiming the film tax credit on your income tax return.

Total Credit Allowed

3. Credit Carried Forward from Prior Years (From Line 11)

_________________

4. Total Credit Available in the Current Year (Line 2(d) plus Line 3)

_________________

_________________

5. Georgia Income Tax Liability for Current Year

6. Remaining Tax Credit (Line 4 minus Line 5, but no less than zero)

_________________

7. Amount to be claimed against Withholding (*See note below)

_________________

8. Remaining Credit to be Carried Forward

_________________

*Credit from previous years is not eligible to be utilized against withholding unless a timely election was

made for the respective prior year. In order to claim the withholding benefit, Form IT-WH must be filed

at least 30 days prior to the filing of the original income tax return or the due date of the income tax

return (including extensions), whichever occurs first.

Carry Forward Credit from Prior Tax Years

Specify Year(s)

9. Amount of Film Tax Credit Generated in Prior Years

__________

_________________

__________

_________________

10. Amount of Film Tax Credit Utilized or Transferred in Prior Years

11. Balance of Film Tax Credit Available to Carry Forward

__________

_________________

Was any of the tax credit from Line 11:

Previously utilized against Withholding? _________ If so, amount and year utilized ________________

Previously claimed against Income Taxes? _________ If so, amount and year claimed________________

Previously Transferred? _____________________ If so, amount and year transferred ________________

Credit transfers must be documented on Form IT-TRANS and mailed to the address on that form or credit

will not be allowed when claimed by the transferee.

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3