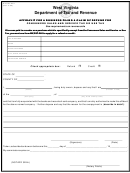

Affidavit For A Business Filing A Claim Of Refund For Consumers Sales And Service Tax Or Use Tax Page 2

ADVERTISEMENT

REQUIREMENTS FOR A REFUND OR CREDIT OF

CONSUMERS SALES AND SERVICE TAX OR USE TAX

This affidavit is to be used when claiming a refund or credit of Consumers Sales and Service or Use

Tax paid in error with your monthly or quarterly Consumers Sales and Service or Use Tax return. If

tax was collected from your customer(s), you must provide proof that the tax was refunded or credited

to your customer(s) before a refund or credit will be issued to your account.

1.

Your tax identification number (as shown on your tax returns).

Name of business.

2.

3 -5.

Complete mailing address. Give telephone number of contact person.

Please indicate refund or credit.

6.

7.

This affidavit must be completed by the owner of the business, the corporate officer, bookkeeper,

or accountant who is responsible for the filing and paying of the Consumers Sales and Service or

Use Tax.

8.

You must file a detailed explanation of the reason(s) for the overpayment; i.e.: the tax was paid

from our own funds for a customer who later supplied a properly executed exemption certificate;

the figures reported on the original return were incorrect due to . . . . .; etc.

This affidavit must be signed by the person responsible for filing the tax returns and paying the tax

9.

and must be notarized.

10.

An amended Consumers Sales and Service or Use Tax return must be filed for the period in which

the tax was originally paid.

11.

In order for you to receive a refund or credit of tax collected from your customer(s), you must attach

a copy of the refund check(s) or credit memo(s) issued to your customer(s).

IF YOU HAVE QUESTIONS OR NEED ASSISTANCE PLEASE CONTACT:

WEST VIRGINIA STATE TAX DEPARTMENT

TAXPAYER SERVICES DIVISION

(304) 558-3333, OR

TOLL-FREE: 1-800-WVA-TAXS (1-800-982-8297)

MAIL TO:

WEST VIRGINIA STATE TAX DEPARTMENT

INTERNAL AUDITING DIVISION

P. O. BOX 1826

CHARLESTON, WEST VIRGINIA 25327-1826

INTERNET ADDRESS:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2