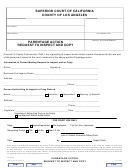

PENALTY CANCELLATION REQUEST

PLEASE REVIEW THIS IMPORTANT INFORMATION

BEFORE COMPLETING YOUR REQUEST

A taxpayer may request cancellation of any penalty assessed on a secured or

unsecured property by completing and submitting this request. The request is required

to be completed with all supporting documentation, and it must be signed.

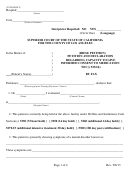

The following summarizes key sections of the California Revenue & Taxation Code

(R&TC) that provide the legal basis to determine when a tax payment is considered

timely, or when a tax penalty cancellation request can be granted. For the complete

R&TC, go to: leginfo.ca.gov/.html/rtc_table_of_contents.html.

2512

A mailed tax payment is considered timely when it is postmarked on or prior to

the delinquency date by the United States Postal Service (foreign postmarks and

private metered postage are not acceptable).

2610.5

Failure to receive annual tax bill is never grounds to cancel a tax penalty.

4911(a)

If the taxpayer can demonstrate that the current taxes were paid on a wrong

parcel, by mistake, Tax Collector shall cancel the credit on the unintended

property and transfer the payment to the property intended; provided the

payment was received on time for the correct amount of the tax due, and before

the property has transferred ownership, and before two years have elapsed since

the date of payment.

4920-4925

A penalty may be cancelled if the taxpayer can demonstrate that prior year taxes

were paid on a wrong parcel, by mistake, and the payment was received on time

for the correct amount of the tax due.

4985

A penalty may be cancelled upon showing proof that the payment was not made

timely, or made in the proper amount, because of information expressly given to

the taxpayer in writing by the County.

4985.2

A penalty may be cancelled if the failure to pay on time is shown to be for

reasons outside the taxpayer’s control, provided the taxpayer exercised “ordinary

care in the absence of willful neglect,” and the principal payment for the proper

amount of the tax due is made no later than June 30 of the fourth fiscal year

following the fiscal year in which the tax became delinquent.

4986

A penalty may be cancelled to correct a specified error on the part of the County.

If you have additional questions, you may call us between 8:00 a.m. and 5:00 p.m.

Pacific Time, Monday through Friday, excluding Los Angeles County holidays, at:

• Secured Property Tax Information at 1(213) 974-2111, or

toll-free within Los Angeles County at 1(888) 807-2111.

• Unsecured Property Tax Information at 1(213) 893-7935.

You may also visit our website at

ttc.lacounty.gov

for general property tax

information.

REV 12/2015

1

1 2

2 3

3