Meal / Dining Expenses Page 2

ADVERTISEMENT

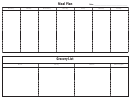

Meal Entertainment Form

Meal / Dining Expenses – What can I claim ?

GOING OUT

DINE-IN

ONLY CLAIM MEAL EXPENSES WHEN YOU ARE

FOR A

MEAL.

A dine-in meal at a restaurant, café, bistro, pub, club – wherever a dine-in

What can I claim ?

meal is provided. No take-away.

See table below

Only claim meal expenses paid by you or a family member in your household.

Yes. A Tax Invoice, receipt or credit card statement. Send us copies. Please

Proof of meal expense ?

keep original

receipts / invoices for 5 years in the event of a tax audit.

ATO Requirement

Please do NOT include invoices / receipts provided by friends, nor family

members not living in your household. That is, do not ‘harvest’ receipts.

Failure to provide receipts means the benefit will be suspended.

Warning

for a form. It’s easy.

The paperless option is …

The Advantage Meal Card. Visit

Your money is deposited onto the Card each pay. The Card is accepted at all

restaurants, cafes etc , wherever Visa is accepted. You may also use the

Card overseas (PIN required). A SMS will confirm the balance each pay.

This is extra tax free earnings. It may be claimed ‘on top of’ the limit ($16,050

Why claim your dining ?

or $9,095). Also, the benefit is NOT reported. This will assist you with any

government income tests – HELP, Centrelink, child support, Medicare Levy.

If using the paperless Advantage Meal Card, simply nominate an amount per

How do I claim ?

pay (eg. $100), and this will be deposited onto the Card. The money is

deducted from your pay pre-tax. Visit

for information.

If using receipts, tell us the annual value of receipts you will provide. For

example. $200 a fortnight is $5,200 a year. We will use the figure nominated.

Expenses Allowed (> $20)

Expenses NOT Allowed STOP !

Take-away meals, lunch (eg. sandwich), snacks –

Meal when you dine-in at a café, restaurant, pub, club,

these are merely ‘sustenance’ according to Tax Office.

bistro. Meal must be a social gathering = 2+ people.

Meal and drinks (alcohol allowed) when you dine in at a

Coffee, coffee & cake (morning tea), drinks only, bottle

café, restaurant, bistro etc. No ‘drinks only’.

shop purchases (refreshments are not meals).

st

, wedding) – food and drink

Catered Functions (eg. 21

Food and drink at football, concerts, movies, theme

only. Not music / bands, photographers etc.

parks etc. These are NOT dine-in meals.

Groceries for a party – all supermarket purchases.

Dine-in meals whilst on holidays as per above.

Advantage Salary Packaging PO Box 8480 Armadale VIC 3143

Ph (03) 9822 3455

Fax (03) 9822 7455

Email .au

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1 2

2