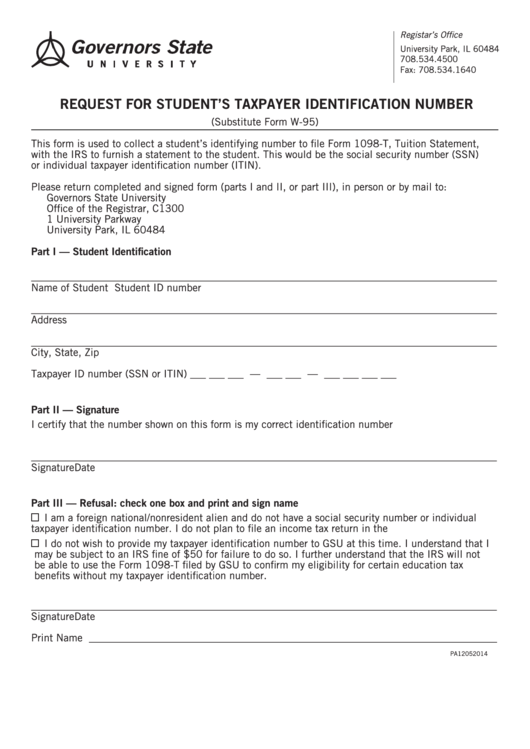

Registar’s Office

University Park, IL 60484

708.534.4500

Fax: 708.534.1640

REQUEST FOR STUDENT’S TAXPAYER IDENTIFICATION NUMBER

(Substitute Form W-95)

This form is used to collect a student’s identifying number to file Form 1098-T, Tuition Statement,

with the IRS to furnish a statement to the student. This would be the social security number (SSN)

or individual taxpayer identification number (ITIN).

Please return completed and signed form (parts I and II, or part III), in person or by mail to:

Governors State University

Office of the Registrar, C1300

1 University Parkway

University Park, IL 60484

Part I — Student Identification

_________________________________________________________________________________________

Name of Student

Student ID number

_________________________________________________________________________________________

Address

_________________________________________________________________________________________

City, State, Zip

Taxpayer ID number (SSN or ITIN) ___ ___ ___ — ___ ___ — ___ ___ ___ ___

Part II — Signature

I certify that the number shown on this form is my correct identification number

_________________________________________________________________________________________

Signature

Date

Part III — Refusal: check one box and print and sign name

I am a foreign national/nonresident alien and do not have a social security number or individual

taxpayer identification number. I do not plan to file an income tax return in the U.S.

I do not wish to provide my taxpayer identification number to GSU at this time. I understand that I

may be subject to an IRS fine of $50 for failure to do so. I further understand that the IRS will not

be able to use the Form 1098-T filed by GSU to confirm my eligibility for certain education tax

benefits without my taxpayer identification number.

_________________________________________________________________________________________

Signature

Date

Print Name ______________________________________________________________________________

PA12052014

1

1