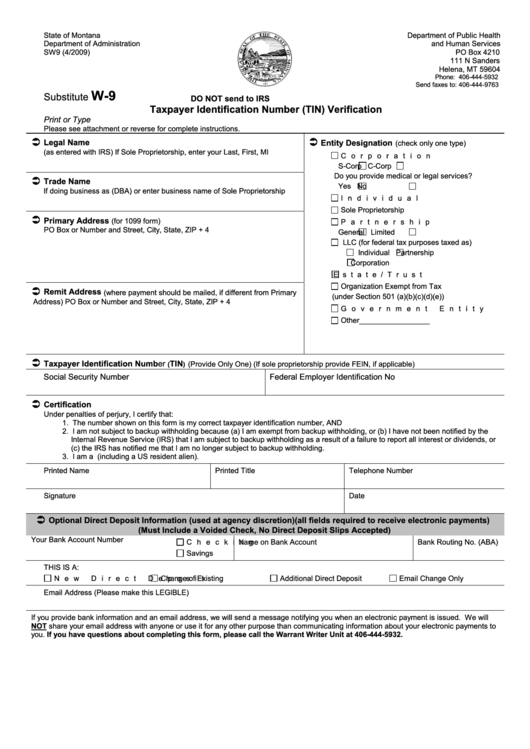

State of Montana

Department of Public Health

Department of Administration

and Human Services

SW9 (4/2009)

PO Box 4210

111 N Sanders

Helena, MT 59604

Phone: 406-444-5932

Send faxes to: 406-444-9763

W-9

Substitute

DO NOT send to IRS

Taxpayer Identification Number (TIN) Verification

Print or Type

Please see attachment or reverse for complete instructions.

Legal Name

Entity Designation

(check only one type)

(as entered with IRS) If Sole Proprietorship, enter your Last, First, MI

Corporation

S-Corp

C-Corp

Do you provide medical or legal services?

Trade Name

Yes

No

If doing business as (DBA) or enter business name of Sole Proprietorship

Individual

Sole Proprietorship

Primary Address

(for 1099 form)

Partnership

PO Box or Number and Street, City, State, ZIP + 4

General

Limited

LLC (for federal tax purposes taxed as)

Individual

Partnership

Corporation

Estate/Trust

Organization Exempt from Tax

Remit Address

(where payment should be mailed, if different from Primary

(under Section 501 (a)(b)(c)(d)(e))

Address) PO Box or Number and Street, City, State, ZIP + 4

Government Entity

Other_________________

Taxpayer Identification Number

TIN

(Provide Only One) (If sole proprietorship provide FEIN, if applicable)

(

)

Social Security Number

Federal Employer Identification No

Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number, AND

2. I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by the

Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or

(c) the IRS has notified me that I am no longer subject to backup withholding.

3. I am a U.S. person (including a US resident alien).

Printed Name

Printed Title

Telephone Number

Signature

Date

Optional Direct Deposit Information (used at agency discretion) (all fields required to receive electronic payments)

(Must Include a Voided Check, No Direct Deposit Slips Accepted)

Your Bank Account Number

Checking

Name on Bank Account

Bank Routing No. (ABA)

Savings

THIS IS A:

New Direct Deposit

Change of Existing

Additional Direct Deposit

Email Change Only

Email Address (Please make this LEGIBLE)

If you provide bank information and an email address, we will send a message notifying you when an electronic payment is issued. We will

NOT share your email address with anyone or use it for any other purpose than communicating information about your electronic payments to

you. If you have questions about completing this form, please call the Warrant Writer Unit at 406-444-5932.

1

1 2

2 3

3