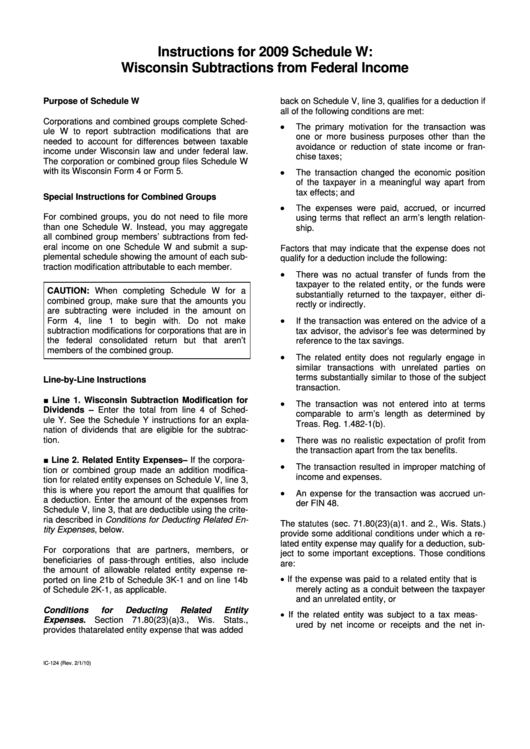

Instructions For 2009 Schedule W: Wisconsin Subtractions From Federal Income

ADVERTISEMENT

Instructions for 2009 Schedule W:

Wisconsin Subtractions from Federal Income

Purpose of Schedule W

back on Schedule V, line 3, qualifies for a deduction if

all of the following conditions are met:

Corporations and combined groups complete Sched-

•

The primary motivation for the transaction was

ule W to report subtraction modifications that are

one or more business purposes other than the

needed to account for differences between taxable

avoidance or reduction of state income or fran-

income under Wisconsin law and under federal law.

chise taxes;

The corporation or combined group files Schedule W

•

with its Wisconsin Form 4 or Form 5.

The transaction changed the economic position

of the taxpayer in a meaningful way apart from

tax effects; and

Special Instructions for Combined Groups

•

The expenses were paid, accrued, or incurred

For combined groups, you do not need to file more

using terms that reflect an arm’s length relation-

than one Schedule W. Instead, you may aggregate

ship.

all combined group members’ subtractions from fed-

eral income on one Schedule W and submit a sup-

Factors that may indicate that the expense does not

plemental schedule showing the amount of each sub-

qualify for a deduction include the following:

traction modification attributable to each member.

•

There was no actual transfer of funds from the

taxpayer to the related entity, or the funds were

CAUTION: When completing Schedule W for a

substantially returned to the taxpayer, either di-

combined group, make sure that the amounts you

rectly or indirectly.

are subtracting were included in the amount on

•

Form 4, line 1 to begin with. Do not make

If the transaction was entered on the advice of a

subtraction modifications for corporations that are in

tax advisor, the advisor’s fee was determined by

the federal consolidated return but that aren’t

reference to the tax savings.

members of the combined group.

•

The related entity does not regularly engage in

similar transactions with unrelated parties on

terms substantially similar to those of the subject

Line-by-Line Instructions

transaction.

■ Line 1. Wisconsin Subtraction Modification for

•

The transaction was not entered into at terms

Dividends – Enter the total from line 4 of Sched-

comparable to arm’s length as determined by

ule Y. See the Schedule Y instructions for an expla-

Treas. Reg. 1.482-1(b).

nation of dividends that are eligible for the subtrac-

•

tion.

There was no realistic expectation of profit from

the transaction apart from the tax benefits.

■ Line 2. Related Entity Expenses – If the corpora-

•

The transaction resulted in improper matching of

tion or combined group made an addition modifica-

income and expenses.

tion for related entity expenses on Schedule V, line 3,

this is where you report the amount that qualifies for

•

An expense for the transaction was accrued un-

a deduction. Enter the amount of the expenses from

der FIN 48.

Schedule V, line 3, that are deductible using the crite-

ria described in Conditions for Deducting Related En-

The statutes (sec. 71.80(23)(a)1. and 2., Wis. Stats.)

tity Expenses, below.

provide some additional conditions under which a re-

lated entity expense may qualify for a deduction, sub-

For corporations that are partners, members, or

ject to some important exceptions. Those conditions

beneficiaries of pass-through entities, also include

are:

the amount of allowable related entity expense re-

•

If the expense was paid to a related entity that is

ported on line 21b of Schedule 3K-1 and on line 14b

merely acting as a conduit between the taxpayer

of Schedule 2K-1, as applicable.

and an unrelated entity, or

Conditions

for

Deducting

Related

Entity

•

If the related entity was subject to a tax meas-

Expenses. Section 71.80(23)(a)3., Wis. Stats.,

ured by net income or receipts and the net in-

provides that a related entity expense that was added

IC-124 (Rev. 2/1/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3