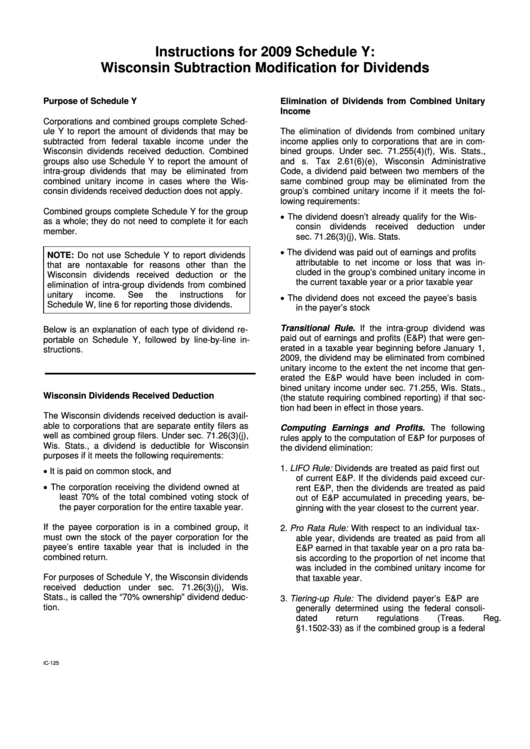

Instructions For 2009 Schedule Y: Wisconsin Subtraction Modification For Dividends

ADVERTISEMENT

Instructions for 2009 Schedule Y:

Wisconsin Subtraction Modification for Dividends

Purpose of Schedule Y

Elimination of Dividends from Combined Unitary

Income

Corporations and combined groups complete Sched-

ule Y to report the amount of dividends that may be

The elimination of dividends from combined unitary

subtracted from federal taxable income under the

income applies only to corporations that are in com-

Wisconsin dividends received deduction. Combined

bined groups. Under sec. 71.255(4)(f), Wis. Stats.,

groups also use Schedule Y to report the amount of

and s. Tax 2.61(6)(e), Wisconsin Administrative

intra-group dividends that may be eliminated from

Code, a dividend paid between two members of the

combined unitary income in cases where the Wis-

same combined group may be eliminated from the

consin dividends received deduction does not apply.

group’s combined unitary income if it meets the fol-

lowing requirements:

Combined groups complete Schedule Y for the group

•

The dividend doesn’t already qualify for the Wis-

as a whole; they do not need to complete it for each

consin dividends received deduction under

member.

sec. 71.26(3)(j), Wis. Stats.

•

The dividend was paid out of earnings and profits

NOTE: Do not use Schedule Y to report dividends

attributable to net income or loss that was in-

that are nontaxable for reasons other than the

cluded in the group’s combined unitary income in

Wisconsin dividends received deduction or the

the current taxable year or a prior taxable year

elimination of intra-group dividends from combined

unitary

income.

See

the

instructions

for

•

The dividend does not exceed the payee’s basis

Schedule W, line 6 for reporting those dividends.

in the payer’s stock

Transitional Rule. If the intra-group dividend was

Below is an explanation of each type of dividend re-

paid out of earnings and profits (E&P) that were gen-

portable on Schedule Y, followed by line-by-line in-

erated in a taxable year beginning before January 1,

structions.

2009, the dividend may be eliminated from combined

unitary income to the extent the net income that gen-

erated the E&P would have been included in com-

bined unitary income under sec. 71.255, Wis. Stats.,

Wisconsin Dividends Received Deduction

(the statute requiring combined reporting) if that sec-

tion had been in effect in those years.

The Wisconsin dividends received deduction is avail-

able to corporations that are separate entity filers as

Computing Earnings and Profits. The following

well as combined group filers. Under sec. 71.26(3)(j),

rules apply to the computation of E&P for purposes of

Wis. Stats., a dividend is deductible for Wisconsin

the dividend elimination:

purposes if it meets the following requirements:

1. LIFO Rule: Dividends are treated as paid first out

•

It is paid on common stock, and

of current E&P. If the dividends paid exceed cur-

•

The corporation receiving the dividend owned at

rent E&P, then the dividends are treated as paid

least 70% of the total combined voting stock of

out of E&P accumulated in preceding years, be-

the payer corporation for the entire taxable year.

ginning with the year closest to the current year.

If the payee corporation is in a combined group, it

2. Pro Rata Rule: With respect to an individual tax-

must own the stock of the payer corporation for the

able year, dividends are treated as paid from all

payee’s entire taxable year that is included in the

E&P earned in that taxable year on a pro rata ba-

combined return.

sis according to the proportion of net income that

was included in the combined unitary income for

For purposes of Schedule Y, the Wisconsin dividends

that taxable year.

received deduction under sec. 71.26(3)(j), Wis.

Stats., is called the “70% ownership” dividend deduc-

3. Tiering-up Rule: The dividend payer’s E&P are

tion.

generally determined using the federal consoli-

dated

return

regulations

(Treas. Reg.

§1.1502-33) as if the combined group is a federal

IC-125

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4