Schedule C Tax Worksheet

ADVERTISEMENT

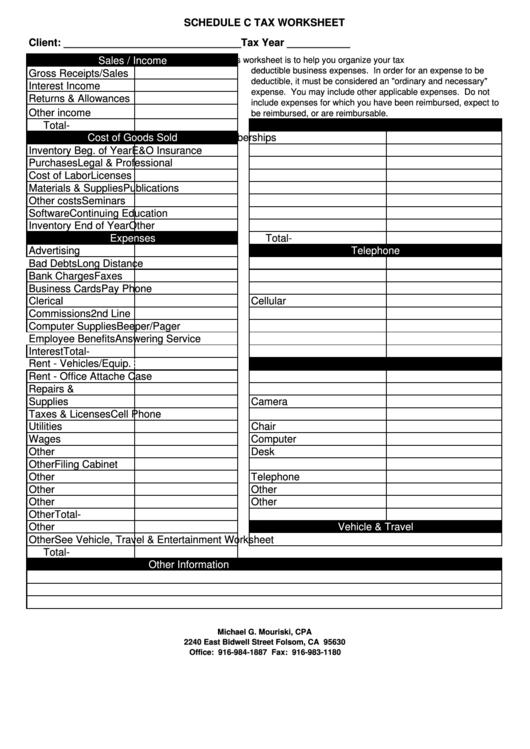

SCHEDULE C TAX WORKSHEET

Client: _______________________________

Tax Year ___________

Sales / Income

The purpose of this worksheet is to help you organize your tax

deductible business expenses. In order for an expense to be

Gross Receipts/Sales

deductible, it must be considered an "ordinary and necessary"

Interest Income

expense. You may include other applicable expenses. Do not

Returns & Allowances

include expenses for which you have been reimbursed, expect to

Other income

be reimbursed, or are reimbursable.

Total

-

Professional

Cost of Goods Sold

Dues & Memberships

Inventory Beg. of Year

E&O Insurance

Purchases

Legal & Professional

Cost of Labor

Licenses

Materials & Supplies

Publications

Other costs

Seminars

Software

Continuing Education

Inventory End of Year

Other

Expenses

Total

-

Advertising

Telephone

Bad Debts

Long Distance

Bank Charges

Faxes

Business Cards

Pay Phone

Clerical

Cellular

Commissions

2nd Line

Computer Supplies

Beeper/Pager

Employee Benefits

Answering Service

Interest

Total

-

Rent - Vehicles/Equip.

Equipment

Rent - Office

Attache Case

Repairs & Maint.

Calculator

Supplies

Camera

Taxes & Licenses

Cell Phone

Utilities

Chair

Wages

Computer

Other

Desk

Other

Filing Cabinet

Other

Telephone

Other

Other

Other

Other

Other

Total

-

Vehicle & Travel

Other

Other

See Vehicle, Travel & Entertainment Worksheet

Total

-

Other Information

Michael G. Mouriski, CPA

2240 East Bidwell Street Folsom, CA 95630

Office: 916-984-1887 Fax: 916-983-1180

michael@mgmcpa.biz

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1