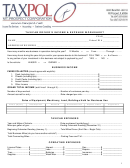

Rental Income Expenses Worksheet 2011 - Beggin Tipp Lamm Llc Page 2

ADVERTISEMENT

page 2

VEHICLES USED IN BUSINESS (If more than 1 vehicle, make a separate list for EACH one)

Mileage

Car #1

Car #2

Total Miles driven for year

Miles used for business

Miles used for commuting

Miles used for personal use

parking fees & tolls

Note: You must have a written record of your mileage. It cannot be estimated.

Mileage is 51 cents per mile for Jan 1, 2011 - June 30, 2011 and 55.5 cents per mile for July 1, 2011- December 31 2011.

If you use your vehicle more that 50% for business purposes and want ot list actual expenses,

then list actual expenses below. If you are taking per mile allowance then skip the actual expenses below.

Vehicle Actual Expenses

Car #1

Car #2

Auto Repairs/Parts (includes

batteries, oil, washing, etc.)

Auto Fuel

Auto License Fees

Auto Insurance

Other (give list)

Interest on business Auto debt

New Business Auto this year:

Car #1

Car #2

Did you keep your old auto

Total cost of New Auto

Date Purchased

Did you use your old Auto for

business?

If so: Trade-in value or sale price

of old auto

Fax to (815)235-9650 OR Mail/Drop off to 524 W. Stephenson St. Suite 200 Freeport, IL 61032

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2