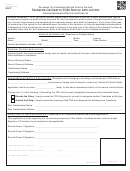

Transfer On Death Form Page 4

Download a blank fillable Transfer On Death Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Transfer On Death Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

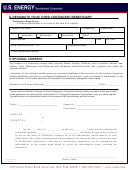

TRANSFER ON DEATH DESIGNATION

This is an OPTIONAL form which may be used by individuals (hereinafter sometimes

referred to as “You”) who own partnership units individually or as a tenant in common. This

form may not be used by individuals who own units with one or more other persons as joint

tenants with rights of survivorship or by partnerships, trusts, corporations, or limited liability

companies. If used by such individuals (i.e. You), this form will determine who receives

title/ownership of the units You identify upon Your death. THE USE OF THIS FORM HAS

LEGAL CONSEQUENCES AND YOU SHOULD CONSULT WITH YOUR LEGAL,

FINANCIAL AND TAX ADVISORS BEFORE UTILIZING IT.

To be effective, this Transfer On Death form (“TOD” form) must be received by the

Managing General Partner of the partnerships in which You own units (U.S. Energy

Development Corporation is currently the Managing General Partner). The TOD form will only

apply to the units You identify and not to any other units You may own or subsequently acquire

or to any of Your other assets. If You dispose of any of the identified units before Your death,

the TOD form will no longer apply to those units or to any units You may receive in exchange

for the identified units.

If used, the Managing General Partner will rely on the TOD form as controlling and

accordingly will not consider any provisions of Your will or any applicable laws of intestate

succession (laws which govern the distribution of the assets of persons who die without a will) to

determine who the successor owner of the identified partnership units is, unless a court of

competent jurisdiction orders otherwise.

The designation of a beneficiary or beneficiaries of Your units in the TOD form will not

be affected by a subsequent change in Your relationship with a designated beneficiary (for

example, as a result of a divorce) or a subsequent change in Your status (for example, if You

marry after executing the TOD form), unless a court of competent jurisdiction orders otherwise.

A change of beneficiary must be made by completing a new TOD form. YOU CAN CHANGE

THE BENEFICIARY DESIGNATION AT ANY TIME BY EXECUTING A NEW TOD

FORM

(INCLUDING

HAVING

YOUR

SIGNATURE

ON

THE

TOD

FORM

ACKNOWLEDGED BY A NOTARY PUBLIC) AND DELIVERING IT TO THE

MANAGING GENERAL PARTNER.

On the TOD form You may designate Your beneficiaries by naming specific individuals

or by identifying a class of beneficiaries, for example, “my children”. In the event You

designate a class of beneficiaries, You must indicate whether the designation is “per stirpes” or

“per capita”. This determines what happens if a member of the class of beneficiaries predeceases

You. For example, if You designate “my children” as the class of beneficiaries, have three

children and one of them predeceases You, survived by two children of his/her own; if You

designate the class as “my children, per capita”, the units would be divided equally between the

two children who survive You or if You designate the class as “my children, per stirpes”, each

- 1 -

_________________

Initials

059522.00009 Business 12016125v1

Rev. Date: 01/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5