Transfer On Death Agreement Form

Download a blank fillable Transfer On Death Agreement Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Transfer On Death Agreement Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset Form

Print Form

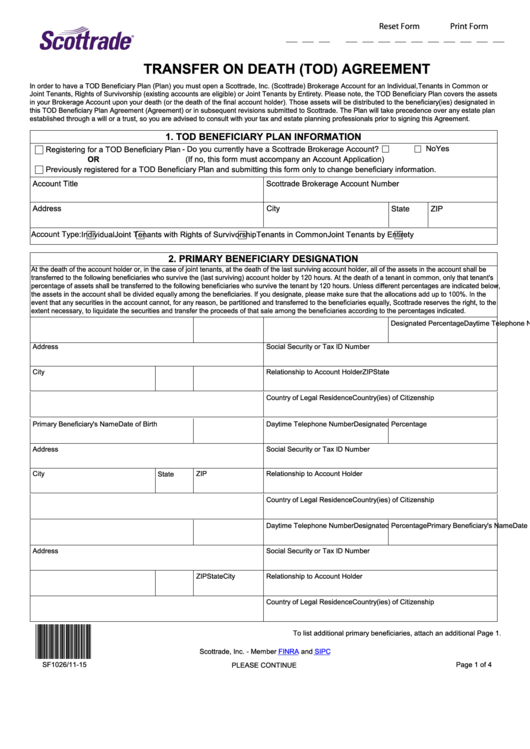

TRANSFER ON DEATH (TOD) AGREEMENT

In order to have a TOD Beneficiary Plan (Plan) you must open a Scottrade, Inc. (Scottrade) Brokerage Account for an Individual,Tenants in Common or

Joint Tenants, Rights of Survivorship (existing accounts are eligible) or Joint Tenants by Entirety. Please note, the TOD Beneficiary Plan covers the assets

in your Brokerage Account upon your death (or the death of the final account holder). Those assets will be distributed to the beneficiary(ies) designated in

this TOD Beneficiary Plan Agreement (Agreement) or in subsequent revisions submitted to Scottrade. The Plan will take precedence over any estate plan

established through a will or a trust, so you are advised to consult with your tax and estate planning professionals prior to signing this Agreement.

1. TOD BENEFICIARY PLAN INFORMATION

Yes

No

Registering for a TOD Beneficiary Plan

- Do you currently have a Scottrade Brokerage Account?

OR

(If no, this form must accompany an Account Application)

Previously registered for a TOD Beneficiary Plan and submitting this form only to change beneficiary information.

Account Title

Scottrade Brokerage Account Number

Address

City

State

ZIP

Account Type:

Individual

Joint Tenants by Entirety

Joint Tenants with Rights of Survivorship

Tenants in Common

2. PRIMARY BENEFICIARY DESIGNATION

At the death of the account holder or, in the case of joint tenants, at the death of the last surviving account holder, all of the assets in the account shall be

transferred to the following beneficiaries who survive the (last surviving) account holder by 120 hours. At the death of a tenant in common, only that tenant's

percentage of assets shall be transferred to the following beneficiaries who survive the tenant by 120 hours. Unless different percentages are indicated below,

the assets in the account shall be divided equally among the beneficiaries. If you designate, please make sure that the allocations add up to 100%. In the

event that any securities in the account cannot, for any reason, be partitioned and transferred to the beneficiaries equally, Scottrade reserves the right, to the

extent necessary, to liquidate the securities and transfer the proceeds of that sale among the beneficiaries according to the percentages indicated.

Primary Beneficiary's Name

Date of Birth

Daytime Telephone Number

Designated Percentage

Address

Social Security or Tax ID Number

City

State

ZIP

Relationship to Account Holder

Country(ies) of Citizenship

Country of Legal Residence

Primary Beneficiary's Name

Date of Birth

Daytime Telephone Number

Designated Percentage

Address

Social Security or Tax ID Number

City

ZIP

Relationship to Account Holder

State

Country(ies) of Citizenship

Country of Legal Residence

Primary Beneficiary's Name

Date of Birth

Daytime Telephone Number

Designated Percentage

Address

Social Security or Tax ID Number

City

State

ZIP

Relationship to Account Holder

Country(ies) of Citizenship

Country of Legal Residence

*SF1026*

To list additional primary beneficiaries, attach an additional Page 1.

Scottrade, Inc. - Member

FINRA

and

SIPC

SF1026/11-15

Page 1 of 4

PLEASE CONTINUE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4