Verification Worksheet

ADVERTISEMENT

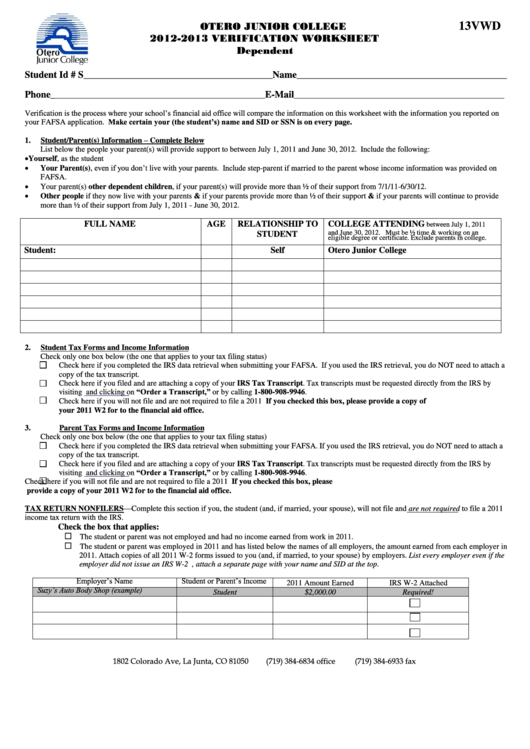

OTERO JUNIOR COLLEGE

13VWD

2012-2013 VERIFICATION WORKSHEET

Dependent

Student Id # S

Name

________________________________________________

______________________________________________________

Phone

E-Mail

_

______________________________________________________

______________________________________________________

Verification is the process where your school’s financial aid office will compare the information on this worksheet with the information you reported on

your FAFSA application. Make certain your (the student’s) name and SID or SSN is on every page.

Student/Parent(s) Information – Complete Below

1.

List below the people your parent(s) will provide support to between July 1, 2011 and June 30, 2012. Include the following:

Yourself, as the student

Your Parent(s), even if you don’t live with your parents. Include step-parent if married to the parent whose income information was provided on

FAFSA.

Your parent(s) other dependent children, if your parent(s) will provide more than ½ of their support from 7/1/11-6/30/12.

Other people if they now live with your parents & if your parents provide more than ½ of their support & if your parents will continue to provide

more than ½ of their support from July 1, 2011 - June 30, 2012.

FULL NAME

AGE

RELATIONSHIP TO

COLLEGE ATTENDING

between July 1, 2011

and June 30, 2012. Must be ½ time & working on an

STUDENT

eligible degree or certificate. Exclude parents in college.

Student:

Self

Otero Junior College

2.

Student Tax Forms and Income Information

Check only one box below (the one that applies to your tax filing status)

Check here if you completed the IRS data retrieval when submitting your FAFSA. If you used the IRS retrieval, you do NOT need to attach a

copy of the tax transcript.

Check here if you filed and are attaching a copy of your IRS Tax Transcript. Tax transcripts must be requested directly from

the IRS by

and clicking on “Order a Transcript,” or by calling 1-800-908-9946.

visiting

Check here if you will not file and are not required to file a 2011 U.S. Income Tax Return. If you checked this box, please provide a copy of

your 2011 W2 for to the financial aid office.

3.

Parent Tax Forms and Income Information

Check only one box below (the one that applies to your tax filing status)

Check here if you completed the IRS data retrieval when submitting your FAFSA. If you used the IRS retrieval, you do NOT need to attach a

copy of the tax transcript.

Check here if you filed and are attaching a copy of your IRS Tax Transcript. Tax transcripts must be requested directly from the IRS by

and clicking on “Order a Transcript,” or by calling 1-800-908-9946.

visiting

Check here if you will not file and are not required to file a 2011 U.S. Income Tax Return. If you checked this box, please

provide a copy of your 2011 W2 for to the financial aid office.

TAX RETURN NONFILERS—Complete this section if you, the student (and, if married, your spouse), will not file and are not required to file a 2011

income tax return with the IRS.

Check the box that applies:

The student or parent was not employed and had no income earned from work in 2011.

The student or parent was employed in 2011 and has listed below the names of all employers, the amount earned from each employer in

2011. Attach copies of all 2011 W-2 forms issued to you (and, if married, to your spouse) by employers. List every employer even if the

employer did not issue an IRS W-2 form. If more space is needed, attach a separate page with your name and SID at the top.

Employer’s Name

Student or Parent’s Income

2011 Amount Earned

IRS W-2 Attached

Suzy’s Auto Body Shop (example)

Student

$2,000.00

Required!

1802 Colorado Ave, La Junta, CO 81050

(719) 384-6834 office

(719) 384-6933 fax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3