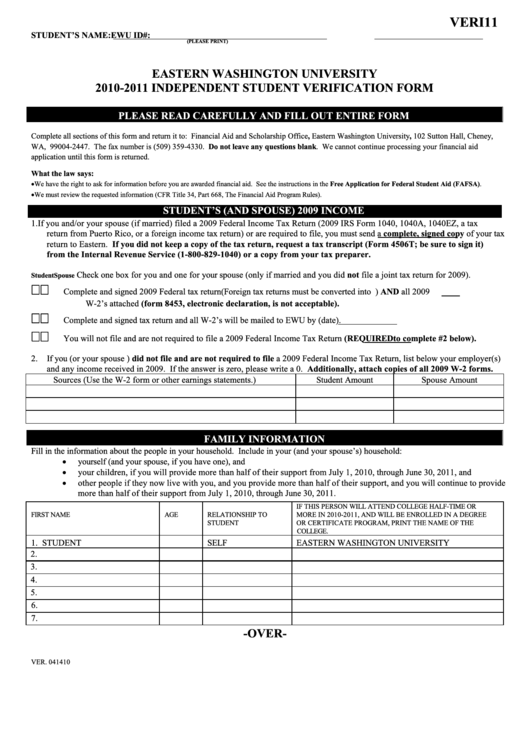

VERI11

STUDENT’S NAME:

EWU ID#:

(PLEASE PRINT)

EASTERN WASHINGTON UNIVERSITY

2010-2011 INDEPENDENT STUDENT VERIFICATION FORM

PLEASE READ CAREFULLY AND FILL OUT ENTIRE FORM

Complete all sections of this form and return it to: Financial Aid and Scholarship Office, Eastern Washington University, 102 Sutton Hall, Cheney,

WA, 99004-2447. The fax number is (509) 359-4330. Do not leave any questions blank. We cannot continue processing your financial aid

application until this form is returned.

What the law says:

•

We have the right to ask for information before you are awarded financial aid. See the instructions in the Free Application for Federal Student Aid (FAFSA).

•

We must review the requested information (CFR Title 34, Part 668, The Financial Aid Program Rules).

STUDENT’S (AND SPOUSE) 2009 INCOME

1.

If you and/or your spouse (if married) filed a 2009 Federal Income Tax Return (2009 IRS Form 1040, 1040A, 1040EZ, a tax

return from Puerto Rico, or a foreign income tax return) or are required to file, you must send a complete, signed copy of your tax

return to Eastern. If you did not keep a copy of the tax return, request a tax transcript (Form 4506T; be sure to sign it)

from the Internal Revenue Service (1-800-829-1040) or a copy from your tax preparer.

Check one box for you and one for your spouse (only if married and you did not file a joint tax return for 2009).

Student

Spouse

Complete and signed 2009 Federal tax return (Foreign tax returns must be converted into U.S. dollars) AND all 2009

W-2’s attached (form 8453, electronic declaration, is not acceptable).

Complete and signed tax return and all W-2’s will be mailed to EWU by

(date).

You will not file and are not required to file a 2009 Federal Income Tax Return (REQUIRED to complete #2 below).

2.

If you (or your spouse ) did not file and are not required to file a 2009 Federal Income Tax Return, list below your employer(s)

and any income received in 2009. If the answer is zero, please write a 0. Additionally, attach copies of all 2009 W-2 forms.

Sources (Use the W-2 form or other earnings statements.)

Student Amount

Spouse Amount

FAMILY INFORMATION

Fill in the information about the people in your household. Include in your (and your spouse’s) household:

•

yourself (and your spouse, if you have one), and

•

your children, if you will provide more than half of their support from July 1, 2010, through June 30, 2011, and

•

other people if they now live with you, and you provide more than half of their support, and you will continue to provide

more than half of their support from July 1, 2010, through June 30, 2011.

IF THIS PERSON WILL ATTEND COLLEGE HALF-TIME OR

FIRST NAME

AGE

RELATIONSHIP TO

MORE IN 2010-2011, AND WILL BE ENROLLED IN A DEGREE

STUDENT

OR CERTIFICATE PROGRAM, PRINT THE NAME OF THE

COLLEGE.

1. STUDENT

SELF

EASTERN WASHINGTON UNIVERSITY

2.

3.

4.

5.

6.

7.

-OVER-

VER. 041410

1

1 2

2