OFFICE OF THE UNIVERSITY REGISTRAR, MIAMI UNIVERSITY

301 S. Campus Avenue, Oxford, Ohio 45056-3433

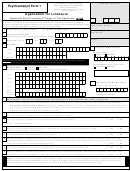

PROCEDURES

Any student classified as a nonresident of the state of Ohio for tuition purposes may apply for resident status by submitting this Application for Resident

Classification for Tuition Purposes. Each application will be reviewed in accordance with the Ohio Administrative Code 3333-1-10 and the criteria established by

the Ohio Board of Regents Guidelines for Residency for State Subsidy and Tuition Purposes.

THE INTENT OF THE GUIDELINES IS TO EXCLUDE FROM RESIDENCY THOSE PERSONS WHO ARE PRESENT IN THE STATE OF OHIO PRIMARILY FOR THE

PURPOSE OF RECEIVING THE BENEFIT OF A STATE-SUPPORTED EDUCATION.

INSTRUCTIONS FOR COMPLETING THE APPLICATION FOR RESIDENT CLASSIFICATION FOR TUITION PURPOSES

Carefully read all instructions before completing the form. Complete and submit all parts of the application. This form is considered an official document, and

any falsification or purposeful omission on this form could be cause for your removal from the University in accordance with Miami University’s Code of Student

Conduct.

After you complete the application, you must have your signed application notarized on the last page of this form. A notary is available at the

Registrar’s Service Center, 102 Campus Avenue Building. The Residency Officer must receive application materials and all required documentation by the

following deadlines in order to be reviewed for the desired semester:

Fall Semester: July 15

Winter Term: December 1

Spring Semester: December 15

Summer Term: April 15

TUITION: You are expected to make full payment (including nonresident fees) by the appropriate payment due date. Payment deadlines cannot be waived or

extended while your residency is being reviewed. Retroactive residency determinations cannot be made for tuition purposes.

Type or legibly print all answers to questions 1 through 12.

1.-9.

Fill in the appropriate information and attach documentation.

10.

Document your residence beginning one year preceding the date you began living in Ohio through the present.

Explain and document all sources of your support.

11.

The minimum documentation required for common sources of income is listed below.

Additional documentation may be requested. Submit all documents that apply to your case.

Employment: Photocopies of W-2 forms for the past year’s earnings, most recent pay stubs for the current year (if they show your full name and year-

to-date earnings), letter(s) from employer(s) on official letterhead stationery (or notarized) indicating the dates of your employment and your total

earnings for the 12-month period of review, or payroll statements if they are readily identifiable.

Savings: If you have used savings that are in your name that you acquired prior to the 12-month period of review, you should list your savings balance

as of the start of the 12-month period of review. For documentation, submit a copy of your bank statement from the start of your 12-month period of

review. Documentation is required to verify all source(s) of your existing savings, or deposits to existing accounts.

Scholarships and Grants: List any scholarships and grants you received during the preceding 12-month period of review and provide copies of your

award letter(s). If you received the scholarship/grant from an out-of-state source, submit a copy of the application instructions or a letter from the

grantor that verifies whether or not you were required to be a resident of a particular state to receive the funds.

Loans: If you have incurred loans directly in your name during the 12-month period of review, list the total amount of the loans. For documentation,

please provide copies of your award letters and disbursement dates. If you received a loan from an out-of-state source, submit a copy of the

application instructions or a letter from the lender that verifies whether or not you were required to be a resident of a particular state to receive the funds.

Fee Payment Authorization: List any fee authorizations/waivers received during the 12-month period of review. Please provide a copy of your award

letter.

Gifts or Support from Parents, Guardians, Relatives, or Friends: If relatives or friends who reside in Ohio provided a portion of your financial support,

submit a notarized letter from them indicating the dates they have resided in Ohio, the amount and type of financial support they have provided you

during the 12-month period of review, and whether or not they are citizens or permanent residents of the United States. The letter should also include a

statement verifying that the support came from the individual’s own financial resources and not from an out-of-state individual. A similar statement

should be provided from sources outside Ohio, including the person’s state or country of legal residency.

VA Benefits, Social Security Benefits: If you have used Veterans Administration, Social Security, unemployment, or welfare benefits, those agencies

must verify, in writing, the amount and type of support you received during the 12-month period of review.

Other: List and describe any other income sources used during the 12-month period of review. Please provide complete and appropriate

documentation for the income source(s).

Indicate all persons who claimed you on their past year’s federal income tax return(s). If you claimed yourself, write “self.” If claimed by anyone

else, indicate their place of residence/domicile and whether or not they will continue to claim you this coming year. Students under 24 years of age

must provide a copy of their parents’ most recent federal income tax return, showing the dependent section.

12.

Fill in the total amounts of your income and expenses for the 12-month period immediately preceding the semester for which you are requesting

reclassification. While completing Section 11, keep in mind that documentation must be submitted for all sources of financial support you received,

used, or anticipate using or receiving during this 12-month period.

1

1 2

2 3

3 4

4