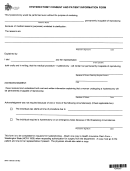

Wisconsin Temporary Event Operator And Seller Information Form Page 2

ADVERTISEMENT

Instructions for Completing Operator and Seller Information

EVENT OPERATOR:

SELLER:

An “operator” is defined as a person or entity (such as an

A “seller” is defined as a person or entity involved with

individual, association, partnership, corporation, or non-

selling merchandise or providing taxable services at a

profit organization) that arranges, organizes, promotes,

temporary event. A seller may also be referred to as a

or sponsors an event. An operator may also be referred

vendor, exhibitor, or booth owner.

to as an organizer, exhibitor, or decorator. An operator

may or may not be the owner of the property or premises

Important: This form is not an application for a

where the event takes place. An operator may also be a

Wisconsin Tax Account Number. If you do not already

seller at the event.

have a tax account number but are required to, you

will need to apply for one directly with the Department

Note: A Wisconsin tax account number (formerly

of Revenue prior to the event. You can apply online or

seller’s permit) is required if selling taxable merchandise

download an application, Application for Business Tax

or services. Admission fees are subject to sales tax in

Registration (Form BTR-101) on the department’s website,

Wisconsin.

revenue.wi.gov/forms/sales/index.html. Not all sellers

are required to obtain a Wisconsin tax account number.

Step 1: Complete Parts A and B.

Some of the reasons a seller may not need a tax account

number are:

Step 2: Provide a copy of Wisconsin Temporary Event

Operator and Seller Information (Form S-240) with Parts A

vegetables for home consumption.

and B completed to each seller participating in your event.

To obtain additional copies of Form S-240 go to the

orders are being taken, and taxable merchandise is not

Department of Revenue’s website at

revenue.wi.gov/

later shipped into Wisconsin.

forms/sales/index.html. If you prefer, you may use the

fill-in form available from the same website.

(See Publication 228, Temporary Events.)

Step 3:

If you have questions regarding applying for a Wisconsin

Submit compiled vendor information to the department

tax account number, contact any Department of Revenue

as soon as possible but no later than 10 days from event

office, visit our website, or call (608) 266-2776.

closing using one of the following methods:

Step 1: Complete Part C (event operator should com-

Electronic Reporting: If you have all the required

plete Parts A and B).

provided at

revenue.wi.gov/html/temevent.html

viewer is available.) Fill in the information for all

corporate name.

sellers participating at the event and submit using the

revenue.wi.gov/eserv/wteptran.html

business. If different, also provide your mailing

address.

Paper Reporting:

printed version of spreadsheet to:

You can find this number on your Form ST-12.

Wisconsin Department of Revenue

This number is not your 6-digit seller’s permit

265 W Northland Ave

number issued to you prior to December 31, 2002.

Appleton WI 54911

number and/or federal employer identification

number. This is required under sec. 73.03(38), Wis.

Revenue Field Agents attend temporary events

Stats., if you do not provide a tax account number.

to verify registration of sellers. Sellers must have

evidence of their Wisconsin tax account number

Step 2: Submit completed form to event operator on or

at the event.

before the first day of the event.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2