Cccs Debt Management Agreement

Download a blank fillable Cccs Debt Management Agreement in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Cccs Debt Management Agreement with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

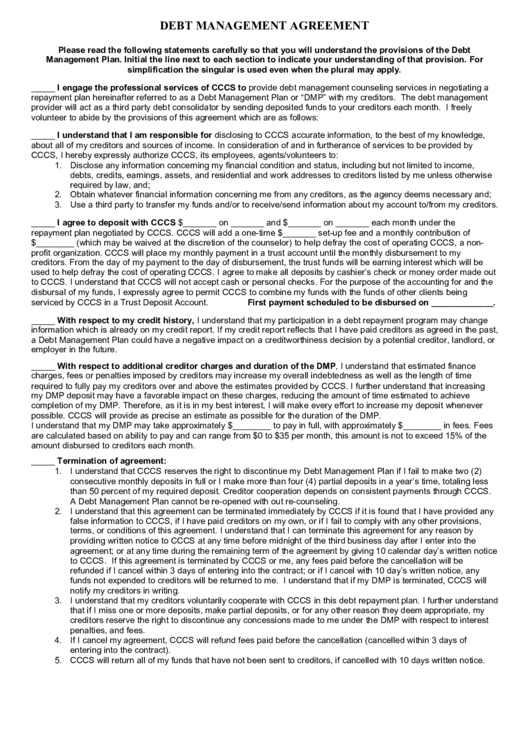

DEBT MANAGEMENT AGREEMENT

Please read the following statements carefully so that you will understand the provisions of the Debt

Management Plan. Initial the line next to each section to indicate your understanding of that provision. For

simplification the singular is used even when the plural may apply.

_____ I engage the professional services of CCCS to provide debt management counseling services in negotiating a

repayment plan hereinafter referred to as a Debt Management Plan or “DMP” with my creditors. The debt management

provider will act as a third party debt consolidator by sending deposited funds to your creditors each month. I freely

volunteer to abide by the provisions of this agreement which are as follows:

_____ I understand that I am responsible for disclosing to CCCS accurate information, to the best of my knowledge,

about all of my creditors and sources of income. In consideration of and in furtherance of services to be provided by

CCCS, I hereby expressly authorize CCCS, its employees, agents/volunteers to:

1. Disclose any information concerning my financial condition and status, including but not limited to income,

debts, credits, earnings, assets, and residential and work addresses to creditors listed by me unless otherwise

required by law, and;

2. Obtain whatever financial information concerning me from any creditors, as the agency deems necessary and;

3. Use a third party to transfer my funds and/or to receive/send information about my account to/from my creditors.

_____ I agree to deposit with CCCS $_______ on _______ and $_______ on _______ each month under the

repayment plan negotiated by CCCS. CCCS will add a one-time $_______ set-up fee and a monthly contribution of

$________ (which may be waived at the discretion of the counselor) to help defray the cost of operating CCCS, a non-

profit organization. CCCS will place my monthly payment in a trust account until the monthly disbursement to my

creditors. From the day of my payment to the day of disbursement, the trust funds will be earning interest which will be

used to help defray the cost of operating CCCS. I agree to make all deposits by cashier’s check or money order made out

to CCCS. I understand that CCCS will not accept cash or personal checks. For the purpose of the accounting for and the

disbursal of my funds, I expressly agree to permit CCCS to combine my funds with the funds of other clients being

serviced by CCCS in a Trust Deposit Account.

First payment scheduled to be disbursed on _____________.

_____ With respect to my credit history, I understand that my participation in a debt repayment program may change

information which is already on my credit report. If my credit report reflects that I have paid creditors as agreed in the past,

a Debt Management Plan could have a negative impact on a creditworthiness decision by a potential creditor, landlord, or

employer in the future.

_____ With respect to additional creditor charges and duration of the DMP, I understand that estimated finance

charges, fees or penalties imposed by creditors may increase my overall indebtedness as well as the length of time

required to fully pay my creditors over and above the estimates provided by CCCS. I further understand that increasing

my DMP deposit may have a favorable impact on these charges, reducing the amount of time estimated to achieve

completion of my DMP. Therefore, as it is in my best interest, I will make every effort to increase my deposit whenever

possible. CCCS will provide as precise an estimate as possible for the duration of the DMP.

I understand that my DMP may take approximately $________ to pay in full, with approximately $________ in fees. Fees

are calculated based on ability to pay and can range from $0 to $35 per month, this amount is not to exceed 15% of the

amount disbursed to creditors each month.

_____ Termination of agreement:

1. I understand that CCCS reserves the right to discontinue my Debt Management Plan if I fail to make two (2)

consecutive monthly deposits in full or I make more than four (4) partial deposits in a year’s time, totaling less

than 50 percent of my required deposit. Creditor cooperation depends on consistent payments through CCCS.

A Debt Management Plan cannot be re-opened with out re-counseling.

2. I understand that this agreement can be terminated immediately by CCCS if it is found that I have provided any

false information to CCCS, if I have paid creditors on my own, or if I fail to comply with any other provisions,

terms, or conditions of this agreement. I understand that I can terminate this agreement for any reason by

providing written notice to CCCS at any time before midnight of the third business day after I enter into the

agreement; or at any time during the remaining term of the agreement by giving 10 calendar day’s written notice

to CCCS. If this agreement is terminated by CCCS or me, any fees paid before the cancellation will be

refunded if I cancel within 3 days of entering into the contract; or if I cancel with 10 day’s written notice, any

funds not expended to creditors will be returned to me. I understand that if my DMP is terminated, CCCS will

notify my creditors in writing.

3. I understand that my creditors voluntarily cooperate with CCCS in this debt repayment plan. I further understand

that if I miss one or more deposits, make partial deposits, or for any other reason they deem appropriate, my

creditors reserve the right to discontinue any concessions made to me under the DMP with respect to interest

penalties, and fees.

4. If I cancel my agreement, CCCS will refund fees paid before the cancellation (cancelled within 3 days of

entering into the contract).

5. CCCS will return all of my funds that have not been sent to creditors, if cancelled with 10 days written notice.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2