r

ris County Tax Assessor-Col

Post Office Box 4520

Houston, Texas 77210-4520

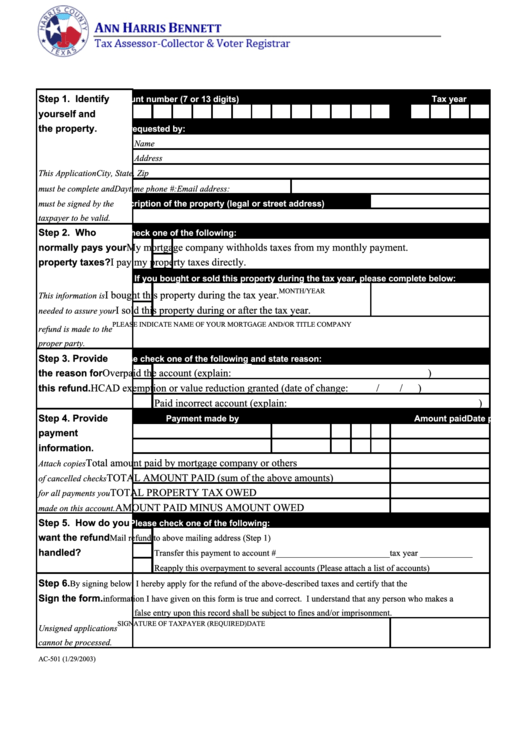

Step 1. Identify

Account number (7 or 13 digits)

Tax year

yourself and

the property.

Refund requested by:

Name

Address

This Application

City, State, Zip

must be complete and

Daytime phone #:

Email address:

must be signed by the

Description of the property (legal or street address)

taxpayer to be valid.

Step 2. Who

Please check one of the following:

My mortgage company withholds taxes from my monthly payment.

normally pays your

I pay my property taxes directly.

property taxes?

If you bought or sold this property during the tax year, please complete below:

MONTH/YEAR

I bought this property during the tax year.

This information is

I sold this property during or after the tax year.

needed to assure your

PLEASE INDICATE NAME OF YOUR MORTGAGE AND/OR TITLE COMPANY

refund is made to the

proper party.

Step 3. Provide

Please check one of the following and state reason:

Overpaid the account (explain:

)

the reason for

HCAD exemption or value reduction granted (date of change:

/

/

)

this refund.

Paid incorrect account (explain:

)

Step 4. Provide

Payment made by

Check No.

Date paid

Amount paid

payment

information.

Total amount paid by mortgage company or others

Attach copies

TOTAL AMOUNT PAID (sum of the above amounts)

of cancelled checks

TOTAL PROPERTY TAX OWED

for all payments you

AMOUNT PAID MINUS AMOUNT OWED

made on this account.

Step 5. How do you

Please check one of the following:

want the refund

Mail refund to above mailing address (Step 1)

handled?

Transfer this payment to account #__________________________tax year ____________

Reapply this overpayment to several accounts (Please attach a list of accounts)

Step 6.

By signing below, I hereby apply for the refund of the above-described taxes and certify that the

Sign the form.

information I have given on this form is true and correct. I understand that any person who makes a

false entry upon this record shall be subject to fines and/or imprisonment.

SIGNATURE OF TAXPAYER (REQUIRED)

DATE

Unsigned applications

cannot be processed.

AC-501 (1/29/2003)

1

1