Pbctc Form 49 - Application For Business Tax Exemption For Disabled Persons, Widows With Minor Dependents Or Persons 65 Years Of Age Or Older - Palm Beach County Tax Collector

ADVERTISEMENT

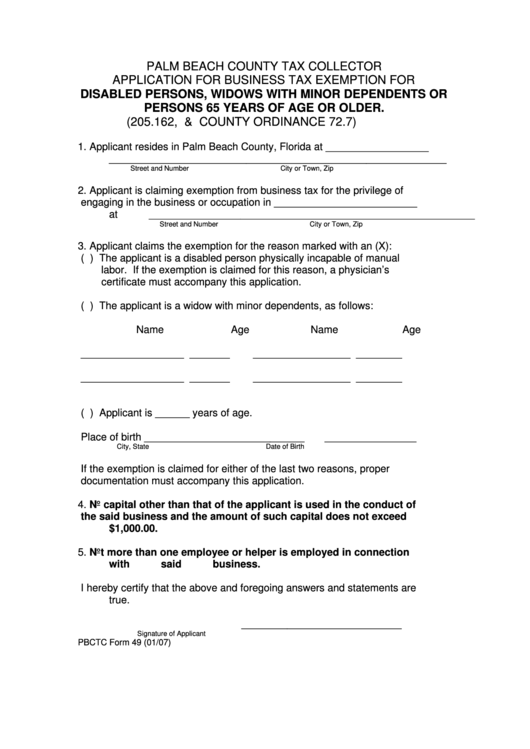

PALM BEACH COUNTY TAX COLLECTOR

APPLICATION FOR BUSINESS TAX EXEMPTION FOR

DISABLED PERSONS, WIDOWS WITH MINOR DEPENDENTS OR

PERSONS 65 YEARS OF AGE OR OLDER.

(205.162, F.S. & P.B. COUNTY ORDINANCE 72.7)

1.

Applicant resides in Palm Beach County, Florida at __________________

___________________________________________________________

Street and Number

City or Town, Zip

2.

Applicant is claiming exemption from business tax for the privilege of

engaging in the business or occupation in _________________________

at _________________________________________________________

Street and Number

City or Town, Zip

3.

Applicant claims the exemption for the reason marked with an (X):

( ) The applicant is a disabled person physically incapable of manual

labor. If the exemption is claimed for this reason, a physician’s

certificate must accompany this application.

( ) The applicant is a widow with minor dependents, as follows:

Name

Age

Name

Age

__________________ _______

_________________ ________

__________________ _______

_________________ ________

( ) Applicant is ______ years of age.

Place of birth ____________________________

________________

City, State

Date of Birth

If the exemption is claimed for either of the last two reasons, proper

documentation must accompany this application.

4.

No capital other than that of the applicant is used in the conduct of

the said business and the amount of such capital does not exceed

$1,000.00.

5.

Not more than one employee or helper is employed in connection

with said business.

I hereby certify that the above and foregoing answers and statements are

true.

____________________________

Signature of Applicant

PBCTC Form 49 (01/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2