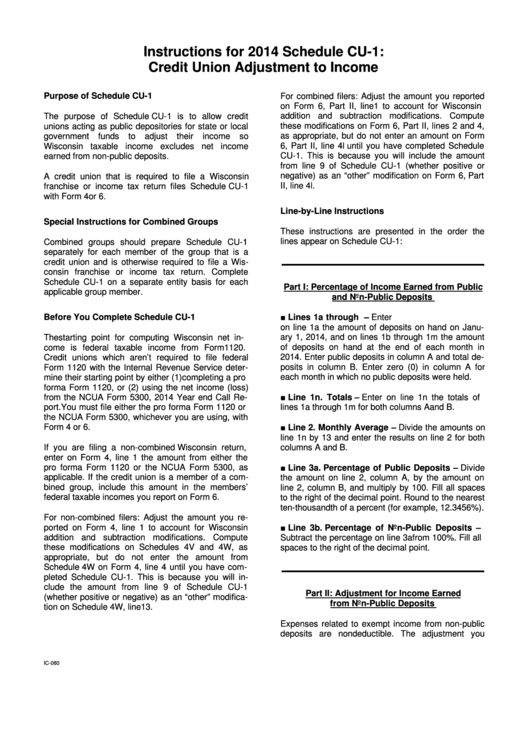

Instructions For 2014 Schedule Cu-1: Credit Union Adjustment To Income

ADVERTISEMENT

Instructions for 2014 Schedule CU-1:

Credit Union Adjustment to Income

Purpose of Schedule CU-1

For combined filers: Adjust the amount you reported

on Form 6, Part II, line 1 to account for Wisconsin

The purpose of Schedule CU-1 is to allow credit

addition and subtraction modifications. Compute

unions acting as public depositories for state or local

these modifications on Form 6, Part II, lines 2 and 4,

government

funds

to

adjust

their

income

so

as appropriate, but do not enter an amount on Form

Wisconsin taxable income excludes net income

6, Part II, line 4l until you have completed Schedule

earned from non-public deposits.

CU-1. This is because you will include the amount

from line 9 of Schedule CU-1 (whether positive or

negative) as an “other” modification on Form 6, Part

A credit union that is required to file a Wisconsin

II, line 4l.

franchise or income tax return files Schedule CU-1

with Form 4 or 6.

Line-by-Line Instructions

Special Instructions for Combined Groups

These instructions are presented in the order the

lines appear on Schedule CU-1:

Combined groups should prepare Schedule CU-1

separately for each member of the group that is a

credit union and is otherwise required to file a Wis-

consin franchise or income tax return. Complete

Schedule CU-1 on a separate entity basis for each

Part I: Percentage of Income Earned from Public

applicable group member.

and Non-Public Deposits

■ Lines 1a through 1m. Deposits on Hand – Enter

Before You Complete Schedule CU-1

on line 1a the amount of deposits on hand on Janu-

ary 1, 2014, and on lines 1b through 1m the amount

The starting point for computing Wisconsin net in-

of deposits on hand at the end of each month in

come is federal taxable income from Form 1120.

2014. Enter public deposits in column A and total de-

Credit unions which aren’t required to file federal

posits in column B. Enter zero (0) in column A for

Form 1120 with the Internal Revenue Service deter-

each month in which no public deposits were held.

mine their starting point by either (1) completing a pro

forma Form 1120, or (2) using the net income (loss)

■ Line 1n. Totals – Enter on line 1n the totals of

from the NCUA Form 5300, 2014 Year end Call Re-

port. You must file either the pro forma Form 1120 or

lines 1a through 1m for both columns A and B.

the NCUA Form 5300, whichever you are using, with

■ Line 2. Monthly Average – Divide the amounts on

Form 4 or 6.

line 1n by 13 and enter the results on line 2 for both

If you are filing a non-combined Wisconsin return,

columns A and B.

enter on Form 4, line 1 the amount from either the

■ Line 3a. Percentage of Public Deposits – Divide

pro forma Form 1120 or the NCUA Form 5300, as

applicable. If the credit union is a member of a com-

the amount on line 2, column A, by the amount on

bined group, include this amount in the members’

line 2, column B, and multiply by 100. Fill all spaces

federal taxable incomes you report on Form 6.

to the right of the decimal point. Round to the nearest

ten-thousandth of a percent (for example, 12.3456%).

For non-combined filers: Adjust the amount you re-

■ Line 3b. Percentage of Non-Public Deposits –

ported on Form 4, line 1 to account for Wisconsin

addition and subtraction modifications. Compute

Subtract the percentage on line 3a from 100%. Fill all

these modifications on Schedules 4V and 4W, as

spaces to the right of the decimal point.

appropriate, but do not enter the amount from

Schedule 4W on Form 4, line 4 until you have com-

pleted Schedule CU-1. This is because you will in-

clude the amount from line 9 of Schedule CU-1

Part II: Adjustment for Income Earned

(whether positive or negative) as an “other” modifica-

from Non-Public Deposits

tion on Schedule 4W, line 13.

Expenses related to exempt income from non-public

deposits are nondeductible. The adjustment you

IC-080

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2