Client Tax Information Sheet

ADVERTISEMENT

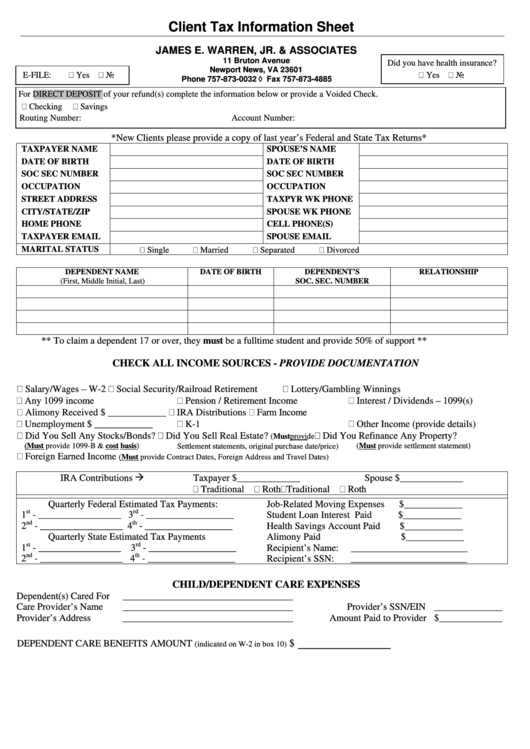

Client Tax Information Sheet

JAMES E. WARREN, JR. & ASSOCIATES

11 Bruton Avenue

Did you have health insurance?

Newport News, VA 23601

E-FILE:

Yes

No

Yes

No

Phone 757-873-0032 ◊ Fax 757-873-4885

For DIRECT DEPOSIT of your refund(s) complete the information below or provide a Voided Check.

Checking

Savings

Routing Number:

Account Number:

*New Clients please provide a copy of last year’s Federal and State Tax Returns*

TAXPAYER NAME

SPOUSE’S NAME

DATE OF BIRTH

DATE OF BIRTH

SOC SEC NUMBER

SOC SEC NUMBER

OCCUPATION

OCCUPATION

STREET ADDRESS

TAXPYR WK PHONE

CITY/STATE/ZIP

SPOUSE WK PHONE

HOME PHONE

CELL PHONE(S)

TAXPAYER EMAIL

SPOUSE EMAIL

MARITAL STATUS

Single

Married

Separated

Divorced

DEPENDENT NAME

DATE OF BIRTH

DEPENDENT’S

RELATIONSHIP

(First, Middle Initial, Last)

SOC. SEC. NUMBER

** To claim a dependent 17 or over, they must be a fulltime student and provide 50% of support **

CHECK ALL INCOME SOURCES - PROVIDE DOCUMENTATION

Salary/Wages – W-2

Social Security/Railroad Retirement

Lottery/Gambling Winnings

Any 1099 income

Pension / Retirement Income

Interest / Dividends – 1099(s)

Alimony Received $ ____________

IRA Distributions

Farm Income

Unemployment $ ____________

K-1

Other Income (provide details)

Did You Sell Any Stocks/Bonds?

Did You Sell Real Estate?

Did You Refinance Any Property?

(Must provide

(Must provide 1099-B & cost basis)

Settlement statements, original purchase date/price)

(Must provide settlement statement)

Foreign Earned Income

(Must provide Contract Dates, Foreign Address and Travel Dates)

IRA Contributions

Taxpayer $_____________

Spouse $_____________

Traditional

Roth

Traditional

Roth

Quarterly Federal Estimated Tax Payments:

Job-Related Moving Expenses

$____________

st

rd

1

- _________________ 3

- __________________

Student Loan Interest Paid

$____________

nd

th

2

- _________________ 4

- __________________

Health Savings Account Paid

$____________

Quarterly State Estimated Tax Payments

Alimony Paid

$____________

st

rd

1

- _________________ 3

- __________________

Recipient’s Name:

________________________

nd

th

2

- _________________ 4

- __________________

Recipient’s SSN:

________________________

CHILD/DEPENDENT CARE EXPENSES

Dependent(s) Cared For

___________________________________

Care Provider’s Name

___________________________________

Provider’s SSN/EIN ______________

Provider’s Address

___________________________________

Amount Paid to Provider $_____________

____________

$

DEPENDENT CARE BENEFITS AMOUNT

(indicated on W-2 in box 10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2