Incentive Withholding Worksheet

ADVERTISEMENT

RESET

PRINT

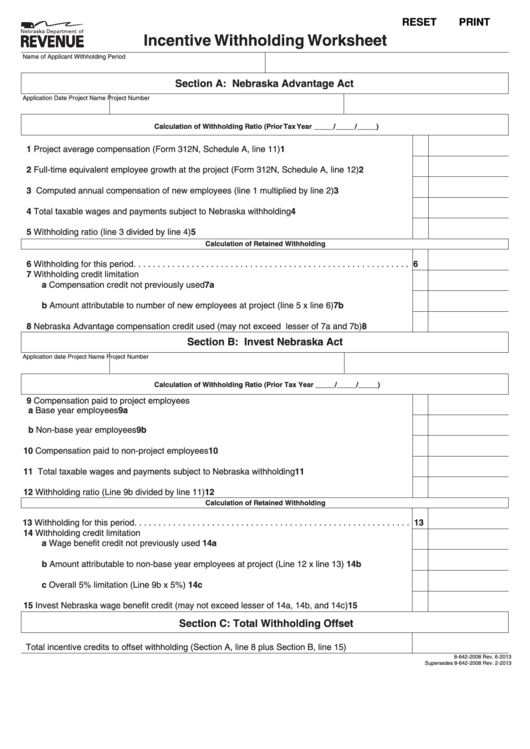

Incentive Withholding Worksheet

Name of Applicant

Withholding Period

Section A: Nebraska Advantage Act

Application Date

Project Name

Project Number

Calculation of Withholding Ratio (Prior Tax Year _____/_____/_____)

1 Project average compensation (Form 312N, Schedule A, line 11) . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Full-time equivalent employee growth at the project (Form 312N, Schedule A, line 12) . . . . . . . . . .

2

3 Computed annual compensation of new employees (line 1 multiplied by line 2) . . . . . . . . . . . . . . .

3

4 Total taxable wages and payments subject to Nebraska withholding . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Withholding ratio (line 3 divided by line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Calculation of Retained Withholding

6 Withholding for this period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Withholding credit limitation

a Compensation credit not previously used . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

b Amount attributable to number of new employees at project (line 5 x line 6) . . . . . . . . . . . . . . . .

7b

8 Nebraska Advantage compensation credit used (may not exceed lesser of 7a and 7b) . . . . . . . . .

8

Section B: Invest Nebraska Act

Application date

Project Name

Project Number

Calculation of Withholding Ratio (Prior Tax Year _____/_____/_____)

9 Compensation paid to project employees

a Base year employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9a

b Non-base year employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9b

10 Compensation paid to non-project employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Total taxable wages and payments subject to Nebraska withholding . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Withholding ratio (Line 9b divided by line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Calculation of Retained Withholding

13 Withholding for this period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Withholding credit limitation

a Wage benefit credit not previously used . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14a

b Amount attributable to non-base year employees at project (Line 12 x line 13) . . . . . . . . . . . . . . 14b

c Overall 5% limitation (Line 9b x 5%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14c

15 Invest Nebraska wage benefit credit (may not exceed lesser of 14a, 14b, and 14c) . . . . . . . . . . . .

15

Section C: Total Withholding Offset

Total incentive credits to offset withholding (Section A, line 8 plus Section B, line 15) . . . . . . . . . . . . .

8-642-2008 Rev . 6-2013

Supersedes 8-642-2008 Rev . 2-2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2