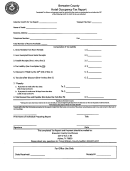

Hotel Motel Tax Collection Form - Hardy County West Virginia Page 2

ADVERTISEMENT

Hotel Occupancy Tax Overview

The County of Hardy imposes a county Hotel/Motel Occupancy Tax upon any

and all hotels, motels, bed and breakfast located in the county. Such tax is six

percent (6%), and is to be levied by the hotel, motel, or bed and breakfast

operator upon the consumer, and included as part of the consideration paid

for the occupancy of the hotel, motel, or bed and breakfast room.

The tax is to be collected by the operator and remitted monthly on a

Hotel/Motel Occupancy Tax Return

to the Sheriff of Hardy County Office on or

th

before the 15

day of the first calendar month following the month in which

the tax was collected. Any operator who fails to file a return and pay the tax

by the due date shall incur penalties of five percent the first month, and one

percent for each additional month.

Hotel or motel occupancy billed directly to the federal government or to any

state or political subdivision shall be exempt from the hotel occupancy tax.

However, rooms paid for by an employee of the federal government or by any

employee of the state or political subdivision for which reimbursement is to

be made, shall be subject to the tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2