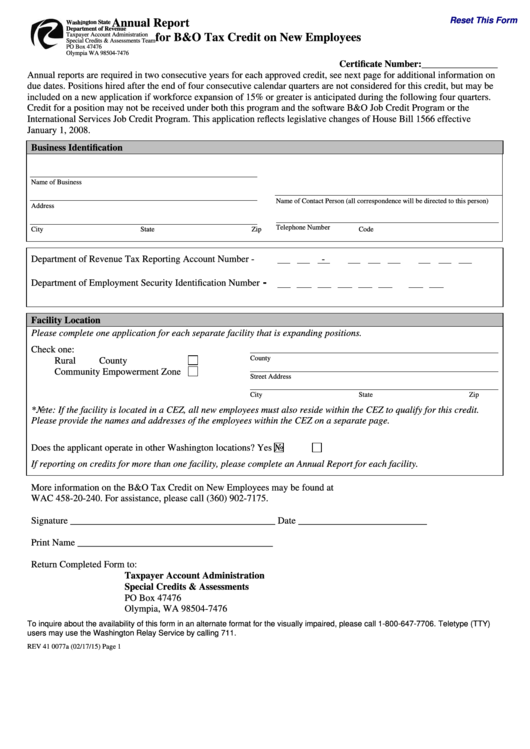

Reset This Form

Annual Report

Washington State

Department of Revenue

Taxpayer Account Administration

for B&O Tax Credit on New Employees

Special Credits & Assessments Team

PO Box 47476

Olympia WA 98504-7476

Certificate Number:________________

Annual reports are required in two consecutive years for each approved credit, see next page for additional information on

due dates. Positions hired after the end of four consecutive calendar quarters are not considered for this credit, but may be

included on a new application if workforce expansion of 15% or greater is anticipated during the following four quarters.

Credit for a position may not be received under both this program and the software B&O Job Credit Program or the

International Services Job Credit Program. This application reflects legislative changes of House Bill 1566 effective

January 1, 2008.

Business Identification

Name of Business

Name of Contact Person (all correspondence will be directed to this person)

Address

Telephone Number

City

State

Zip Code

Department of Revenue Tax Reporting Account Number

-

-

-

Department of Employment Security Identification Number

Facility Location

Please complete one application for each separate facility that is expanding positions.

Check one:

County

Rural County

Community Empowerment Zone

Street Address

City

State

Zip Code

*Note: If the facility is located in a CEZ, all new employees must also reside within the CEZ to qualify for this credit.

Please provide the names and addresses of the employees within the CEZ on a separate page.

Does the applicant operate in other Washington locations?

Yes

No

If reporting on credits for more than one facility, please complete an Annual Report for each facility.

More information on the B&O Tax Credit on New Employees may be found at dor.wa.gov. Please refer to RCW 82.62 or

WAC 458-20-240. For assistance, please call (360) 902-7175.

Signature ___________________________________________ Date ___________________________

Print Name _________________________________________

Return Completed Form to:

Taxpayer Account Administration

Special Credits & Assessments

PO Box 47476

Olympia, WA 98504-7476

To inquire about the availability of this form in an alternate format for the visually impaired, please call 1-800-647-7706. Teletype (TTY)

users may use the Washington Relay Service by calling 711.

REV 41 0077a (02/17/15)

Page 1

1

1 2

2