For Application Processing Purposes Page 2

ADVERTISEMENT

____

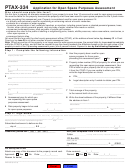

Income Tax Credits ONLY: Credits should be claimed using Maryland Tax Form 500Z and a copy of the

approval letter from the Washington County Department of Business Development.

____

$1,000 per “non-disadvantaged” employee for the first year after hired

____

$3,000 per “disadvantaged” employee (as identified by the Job Service) for year after hired

____

$2,000 per “disadvantaged” employee second year after remaining employed or being replaced

ONLY by another approved “disadvantaged” employee (per Job Service)

____

$1,000 per “disadvantaged” employee third year after remaining employed or being replaced

ONLY by another approved “disadvantaged” employee (per Job Service).

NOTE: After initial approval as a business in an Enterprise Zone, the company does not need to reapply

for additional job credits. Contact Job Service to identify any “disadvantaged” employees, then claim credits.

Additional Information to Help You Through the Process:

____

Contact the Washington County Department of Business Development:

Ph: 240-313-2280

Fx: 240-313-2281

Email:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4