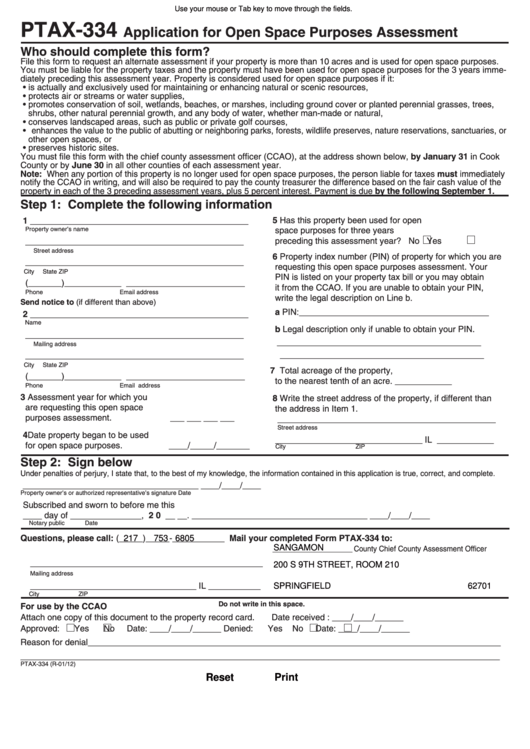

Use your mouse or Tab key to move through the fields.

PTAX-334

Application for Open Space Purposes Assessment

Who should complete this form?

File this form to request an alternate assessment if your property is more than 10 acres and is used for open space purposes.

You must be liable for the property taxes and the property must have been used for open space purposes for the 3 years imme-

diately preceding this assessment year. Property is considered used for open space purposes if it:

• is actually and exclusively used for maintaining or enhancing natural or scenic resources,

• protects air or streams or water supplies,

• promotes conservation of soil, wetlands, beaches, or marshes, including ground cover or planted perennial grasses, trees,

shrubs, other natural perennial growth, and any body of water, whether man-made or natural,

• conserves landscaped areas, such as public or private golf courses,

• enhances the value to the public of abutting or neighboring parks, forests, wildlife preserves, nature reservations, sanctuaries, or

other open spaces, or

• preserves historic sites.

You must file this form with the chief county assessment officer (CCAO), at the address shown below, by January 31 in Cook

County or by June 30 in all other counties of each assessment year.

Note: When any portion of this property is no longer used for open space purposes, the person liable for taxes must immediately

notify the CCAO in writing, and will also be required to pay the county treasurer the difference based on the fair cash value of the

property in each of the 3 preceding assessment years, plus 5 percent interest. Payment is due by the following September 1.

Step 1: Complete the following information

5 Has this property been used for open

1 ______________________________________________

Property owner’s name

space purposes for three years

preceding this assessment year?

No

Yes

______________________________________________

Street address

6 Property index number (PIN) of property for which you are

______________________________________________

requesting this open space purposes assessment. Your

City

State

ZIP

PIN is listed on your property tax bill or you may obtain

(_______)____________ _________________________

it from the CCAO. If you are unable to obtain your PIN,

Phone

Email address

write the legal description on Line b.

Send notice to (if different than above)

a

PIN:________________________________________

2 ______________________________________________

Name

b Legal description only if unable to obtain your PIN.

______________________________________________

___________________________________________

Mailing address

___________________________________________

______________________________________________

City

State

ZIP

7 Total acreage of the property,

(_______)____________ _________________________

to the nearest tenth of an acre.

____________

Phone

Email address

3 Assessment year for which you

8 Write the street address of the property, if different than

are requesting this open space

the address in Item 1.

___ ___ ___ ___

purposes assessment.

______________________________________________

Street address

4

Date property began to be used

_______________________________ IL ____________

for open space purposes. ____/_____/_______

City

ZIP

Step 2: Sign below

Under penalties of perjury, I state that, to the best of my knowledge, the information contained in this application is true, correct, and complete.

_ _____________________________________ ____/____/____

Property owner’s or authorized representative’s signature

Date

S ubscribed and sworn to before me this

_ ___ day of _______________, 2 0 __ __.

______________________________________ ____/____/____

Notary public

Date

Questions, please call: (_____)_____-___________

Mail your completed Form PTAX-334 to:

217

753 6805

___________________ County Chief County Assessment Officer

SANGAMON

_________________________________________________

200 S 9TH STREET, ROOM 210

Mailing address

___________________________________ IL ___________

SPRINGFIELD

62701

City

ZIP

Do not write in this space.

For use by the CCAO

Attach one copy of this document to the property record card. Date received : ____/____/______

Approved: Yes No Date: ____/____/______

Denied: Yes

No Date: ____/____/______

Reason for denial_______________________________________________________________________________________

_____________________________________________________________________________________________________

PTAX-334 (R-01/12)

Print

Reset

1

1