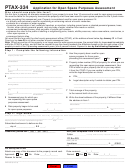

For Application Processing Purposes Page 4

ADVERTISEMENT

Request for Enterprise Zone Qualification

For Application Processing Purposes, You Must Complete ALL Questions Below:

θ

θ

θ

θ

Is the applicant:

New

Expanding

Relocating

Renovating

Name of the Business (products/services) in the Enterprise Zone: _______________________________________________

North American Industry Classification System (NAICS) code: _________________________________________________

Contact Person: _______________________________________________________________________________________

Mailing Address: _____________________________________________________________________________________

Telephone Number: ___________________________________________________________________________________

Facsimile Number: ____________________________________________________________________________________

Signature of Person Completing Form: _______________________________________________ Date: _______________

Printed Name/Title of Person Completing Form: ____________________________________________________________

Please check appropriate Enterprise Zone below:

θ

City of Hagerstown/Washington County Enterprise Zone

θ

Hancock Enterprise Zone

For Local Property Tax Credits Only (Construction or Rehabilitation of Buildings):

.

Note: The Enterprise Zone Program requires a minimum of capital investment. Proof of expenditures for construction may be required

Address of Property in the Enterprise Zone: ________________________________________________________________

Name of Property Owner: ______________________________________________________________________________

Address of Property Owner (if different than above): _________________________________________________________

Is property located within city/town limits? Yes______ No_______

Property Tax District Number (two digits): _________ Property Tax Account Number (six digits): __________________

θ

θ

Is this project:

New Construction

Rehabilitation

Project Starting Date: __________________________ Expected Completion Date: _______________________________

* Estimated Cost of Project:

Land Purchase

$ __________________

Building Purchase

$ __________________

Construction Cost

$ __________________

Rehabilitation Cost

$ __________________

Machinery & Equipment

$ __________________ (not eligible for credits)

For State Income Tax Credits Only (New Jobs Created):

Note: The Enterprise Zone Program requires a minimum number of new jobs created. A list of new hires must

be submitted to the WCDBD (for initial zone qualification) prior to claiming credits. “New jobs” for tax credit

purposes are full time (35 hours or more per week), permanent positions (employed at least six months before

claiming credit) which have not previously existed in Washington County, Maryland, before the business

expanded or located in an Enterprise Zone.

Business Tax Year: From: ________________ (month/day)

To: ________________ (month/day)

Number of Employees before locating or expanding in an Enterprise Zone:

Full Time (35 hours or more per week): ____________ Part Time (less than 35 hours per week): ____________

Number of New Jobs created in the Enterprise Zone:

Non-disadvantaged (not JTPA eligible): ____________

Disadvantaged (JTPA eligible): ___________________

Projected Annual Payroll for these New Jobs:

Non-disadvantaged: $ ________________

Disadvantaged: $ __________________

Please submit application to:

Washington County Department of Business Development

100 West Washington Street, Room 103

Hagerstown, MD 21740-4710

240-313-2280

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4