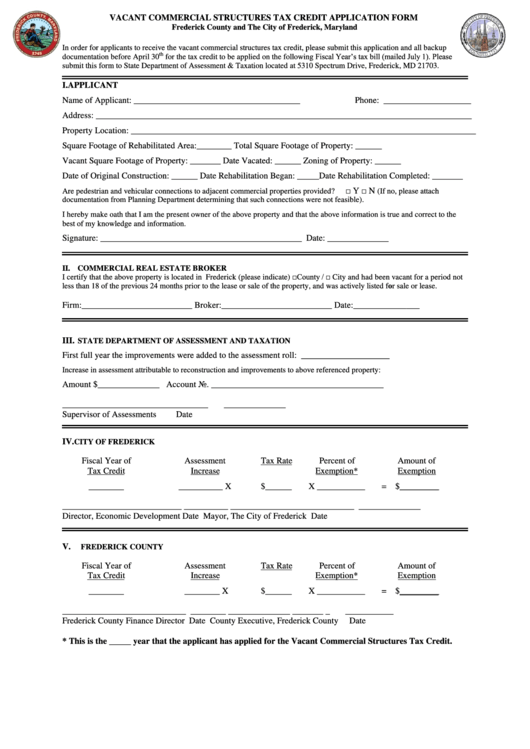

Vacant Commercial Structures Tax Credit Application Form

ADVERTISEMENT

VACANT COMMERCIAL STRUCTURES TAX CREDIT APPLICATION FORM

Frederick County and The City of Frederick, Maryland

In order for applicants to receive the vacant commercial structures tax credit, please submit this application and all backup

th

for the tax credit to be applied on the following Fiscal Year’s tax bill (mailed July 1). Please

documentation before April 30

submit this form to State Department of Assessment & Taxation located at 5310 Spectrum Drive, Frederick, MD 21703.

I. APPLICANT

Name of Applicant: ______________________________________

Phone: ____________________

Address: _____________________________________________________________________________________

Property Location: ______________________________________________________________________________

Square Footage of Rehabilitated Area:________

Total Square Footage of Property: ______

Vacant Square Footage of Property: _______

Date Vacated: ______

Zoning of Property: ______

Date of Original Construction: ______ Date Rehabilitation Began: _____Date Rehabilitation Completed: _______

□ Y □ N

Are pedestrian and vehicular connections to adjacent commercial properties provided?

(If no, please attach

documentation from Planning Department determining that such connections were not feasible).

I hereby make oath that I am the present owner of the above property and that the above information is true and correct to the

best of my knowledge and information.

Signature: ______________________________________________

Date: ______________

II. COMMERCIAL REAL ESTATE BROKER

I certify that the above property is located in Frederick (please indicate) □ County / □ City and had been vacant for a period not

less than 18 of the previous 24 months prior to the lease or sale of the property, and was actively listed for sale or lease.

Firm:_________________________

Broker:_________________________

Date:_______________

III.

STATE DEPARTMENT OF ASSESSMENT AND TAXATION

First full year the improvements were added to the assessment roll: ____________________

Increase in assessment attributable to reconstruction and improvements to above referenced property:

Amount $______________

Account No. _______________________________________

_________________________________

______________

Supervisor of Assessments

Date

IV.

CITY OF FREDERICK

Fiscal Year of

Assessment

Tax Rate

Percent of

Amount of

Tax Credit

Increase

Exemption*

Exemption

________

__________ X

$______

X ___________

= $_________

___________________________ __________

____________________________

______________

Director, Economic Development Date

Mayor, The City of Frederick

Date

V.

FREDERICK COUNTY

Fiscal Year of

Assessment

Tax Rate

Percent of

Amount of

Tax Credit

Increase

Exemption*

Exemption

________

________ X

$______

X ___________

= $_________

____________________________

________

______________ _______ _

___________

Frederick County Finance Director

Date

County Executive, Frederick County

Date

* This is the _____ year that the applicant has applied for the Vacant Commercial Structures Tax Credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1