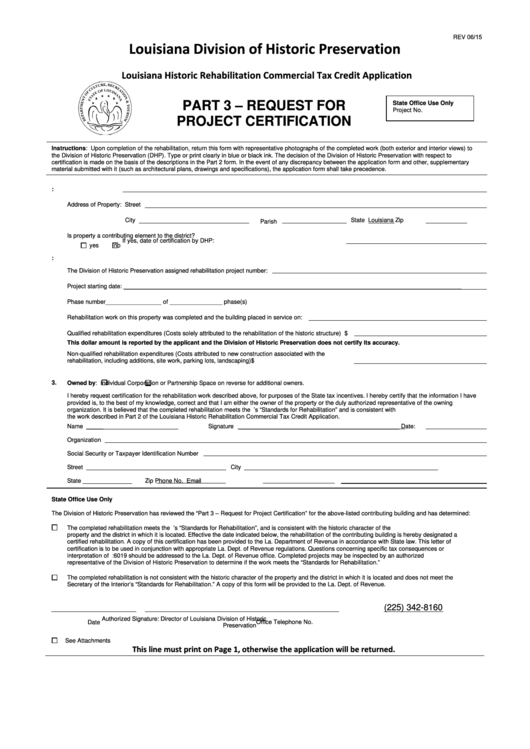

REV 06/15

Louisiana Division of Historic Preservation

Louisiana Historic Rehabilitation Commercial Tax Credit Application

PART 3 – REQUEST FOR

State Office Use Only

Project No.

PROJECT CERTIFICATION

Instructions: Upon completion of the rehabilitation, return this form with representative photographs of the completed work (both exterior and interior views) to

the Division of Historic Preservation (DHP). Type or print clearly in blue or black ink. The decision of the Division of Historic Preservation with respect to

certification is made on the basis of the descriptions in the Part 2 form. In the event of any discrepancy between the application form and other, supplementary

material submitted with it (such as architectural plans, drawings and specifications), the application form shall take precedence.

1.

Name of Property:

Address of Property: Street

City

State Louisiana

Zip

Parish

Is property a contributing element to the district?

If yes, date of certification by DHP:

yes

no

2.

Data on rehabilitation project:

The Division of Historic Preservation assigned rehabilitation project number:

Project starting date:

_______________________________________________________________________________________________________

Phase number_________________ of ________________ phase(s)

Rehabilitation work on this property was completed and the building placed in service on:

Qualified rehabilitation expenditures (Costs solely attributed to the rehabilitation of the historic structure) $

This dollar amount is reported by the applicant and the Division of Historic Preservation does not certify its accuracy.

Non-qualified rehabilitation expenditures (Costs attributed to new construction associated with the

rehabilitation, including additions, site work, parking lots, landscaping)

$

3.

Owned by:

Individual

Corporation or Partnership

Space on reverse for additional owners.

I hereby request certification for the rehabilitation work described above, for purposes of the State tax incentives. I hereby certify that the information I have

provided is, to the best of my knowledge, correct and that I am either the owner of the property or the duly authorized representative of the owning

organization. It is believed that the completed rehabilitation meets the U.S. Secretary of the Interior’s “Standards for Rehabilitation” and is consistent with

the work described in Part 2 of the Louisiana Historic Rehabilitation Commercial Tax Credit Application.

Name

____________________________

Signature _________________________________________________

Date:

Organization

Social Security or Taxpayer Identification Number

Street

________________________________ __________________

City

____________________________________________________

Email

State _______________

Zip

Phone No.

State Office Use Only

The Division of Historic Preservation has reviewed the “Part 3 – Request for Project Certification” for the above-listed contributing building and has determined:

The completed rehabilitation meets the U.S. Secretary of the Interior’s “Standards for Rehabilitation”, and is consistent with the historic character of the

property and the district in which it is located. Effective the date indicated below, the rehabilitation of the contributing building is hereby designated a

certified rehabilitation. A copy of this certification has been provided to the La. Department of Revenue in accordance with State law. This letter of

certification is to be used in conjunction with appropriate La. Dept. of Revenue regulations. Questions concerning specific tax consequences or

interpretation of R.S. 47:6019 should be addressed to the La. Dept. of Revenue office. Completed projects may be inspected by an authorized

representative of the Division of Historic Preservation to determine if the work meets the “Standards for Rehabilitation.”

The completed rehabilitation is not consistent with the historic character of the property and the district in which it is located and does not meet the U.S.

Secretary of the Interior’s “Standards for Rehabilitation.” A copy of this form will be provided to the La. Dept. of Revenue.

(225) 342-8160

Authorized Signature: Director of Louisiana Division of Historic

Date

Office Telephone No.

Preservation

See Attachments

This line must print on Page 1, otherwise the application will be returned.

1

1 2

2