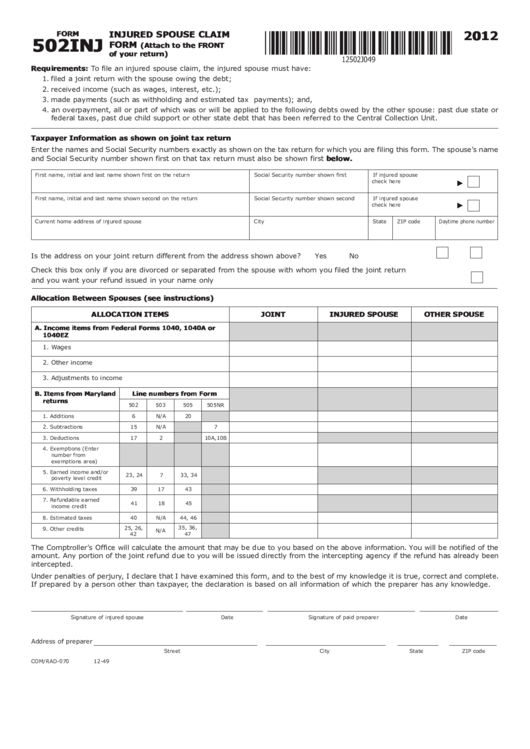

2012

INJURED SPOUSE CLAIM

FORM

502INJ

FORM

(Attach to the FRONT

of your return)

Requirements: To file an injured spouse claim, the injured spouse must have:

1. filed a joint return with the spouse owing the debt;

2. received income (such as wages, interest, etc.);

3. made payments (such as withholding and estimated tax payments); and,

4. an overpayment, all or part of which was or will be applied to the following debts owed by the other spouse: past due state or

federal taxes, past due child support or other state debt that has been referred to the Central Collection Unit.

Taxpayer Information as shown on joint tax return

Enter the names and Social Security numbers exactly as shown on the tax return for which you are filing this form. The spouse’s name

and Social Security number shown first on that tax return must also be shown first below.

First name, initial and last name shown first on the return

Social Security number shown first

If injured spouse

check here

First name, initial and last name shown second on the return

Social Security number shown second

If injured spouse

check here

Current home address of injured spouse

City

State

ZIP code

Daytime phone number

Is the address on your joint return different from the address shown above? . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Check this box only if you are divorced or separated from the spouse with whom you filed the joint return

and you want your refund issued in your name only . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Allocation Between Spouses (see instructions)

ALLOCATION ITEMS

JOINT

INJURED SPOUSE

OTHER SPOUSE

A. Income items from Federal Forms 1040, 1040A or

1040EZ

1. Wages

2. Other income

3. Adjustments to income

B. Items from Maryland

Line numbers from Form

returns

502

503

505

505NR

1. Additions

6

N/A

20

2. Subtractions

15

N/A

7

3. Deductions

17

2

10A,10B

4. Exemptions (Enter

number from

exemptions area)

5. Earned income and/or

23, 24

7

33, 34

poverty level credit

6. Withholding taxes

39

17

43

7. Refundable earned

41

18

45

income credit

8. Estimated taxes

40

N/A

44, 46

25, 26,

35, 36,

9. Other credits

N/A

42

47

The Comptroller’s Office will calculate the amount that may be due to you based on the above information. You will be notified of the

amount. Any portion of the joint refund due to you will be issued directly from the intercepting agency if the refund has already been

intercepted.

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge it is true, correct and complete.

If prepared by a person other than taxpayer, the declaration is based on all information of which the preparer has any knowledge.

Signature of injured spouse

Date

Signature of paid preparer

Date

Address of preparer

Street

City

State

ZIP code

COM/RAD-070

12-49

1

1 2

2