Print

Reset

Save

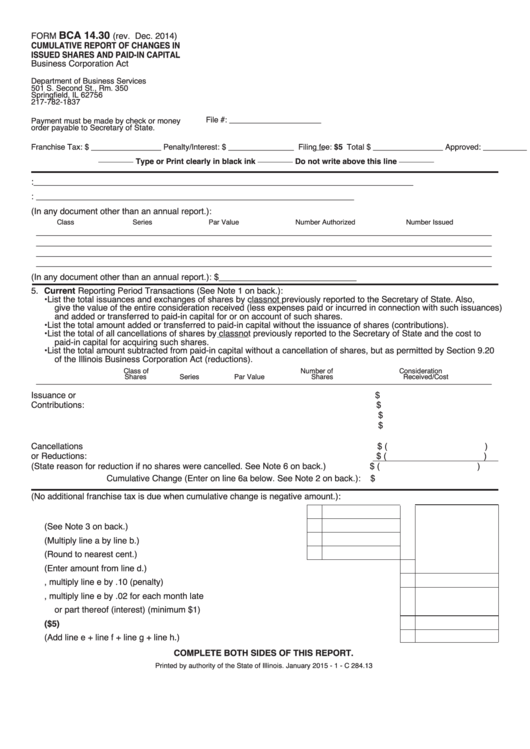

BCA 14.30

FORM

(rev. Dec. 2014)

CUMULATIVE REPORT OF CHANGES IN

ISSUED SHARES AND PAID-IN CAPITAL

Business Corporation Act

Department of Business Services

501 S. Second St., Rm. 350

Springfield, IL 62756

217-782-1837

File #: _____________________

Payment must be made by check or money

order payable to Secretary of State.

Franchise Tax: $ ________________ Penalty/Interest: $ _______________ Filing fee: $5 Total $ ________________ Approved: __________

________ Type or Print clearly in black ink ________ Do not write above this line ________

1. Corporate Name: ________________________________________________________________________________

2. State or Country of Incorporation: ___________________________________________________________________

3. Authorized and Issued Shares as last reported (In any document other than an annual report.):

Class

Series

Par Value

Number Authorized

Number Issued

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

4. Paid-in Capital as last reported (In any document other than an annual report.): $ _____________________________

5. Current Reporting Period Transactions (See Note 1 on back.):

• List the total issuances and exchanges of shares by class not previously reported to the Secretary of State. Also,

give the value of the entire consideration received (less expenses paid or incurred in connection with such issuances)

and added or transferred to paid-in capital for or on account of such shares.

• List the total amount added or transferred to paid-in capital without the issuance of shares (contributions).

• List the total of all cancellations of shares by class not previously reported to the Secretary of State and the cost to

paid-in capital for acquiring such shares.

• List the total amount subtracted from paid-in capital without a cancellation of shares, but as permitted by Section 9.20

of the Illinois Business Corporation Act (reductions).

Class of

Number of

Consideration

________________________________________________________________________________________________

Shares

Series

Par Value

Shares

Received/Cost

Issuance or

$

Contributions:

$

$

$

Cancellations

$ ( )

or Reductions:

$ ( )

(State reason for reduction if no shares were cancelled. See Note 6 on back.)

$ ( )

Cumulative Change (Enter on line 6a below. See Note 2 on back.):

$

6. Franchise Tax and Fees (No additional franchise tax is due when cumulative change is negative amount.):

a. Cumulative Change ......................................................................

a.

b. Applicable Allocation Factor (See Note 3 on back.) .....................

b.

c. Taxable Illinois Capital (Multiply line a by line b.) .........................

c.

d. Multiply line c by .0015 (Round to nearest cent.) .........................

d.

e. Additional Franchise Tax (Enter amount from line d.) .........................................................

e.

f. If Cumulative Report is late, multiply line e by .10 (penalty) ...............................................

f.

g. If Additional Franchise Tax is late, multiply line e by .02 for each month late

or part thereof (interest) (minimum $1)................................................................................

g.

h. FILING FEE ($5)..................................................................................................................

h.

5.00

i. Total Amount Due (Add line e + line f + line g + line h.)......................................................

i.

COMPLETE BOTH SIDES OF THIS REPORT.

Printed by authority of the State of Illinois. January 2015 - 1 - C 284.13

1

1 2

2