Form 91 - Income Analysis Form

Download a blank fillable Form 91 - Income Analysis Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 91 - Income Analysis Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

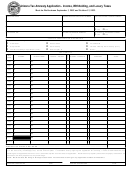

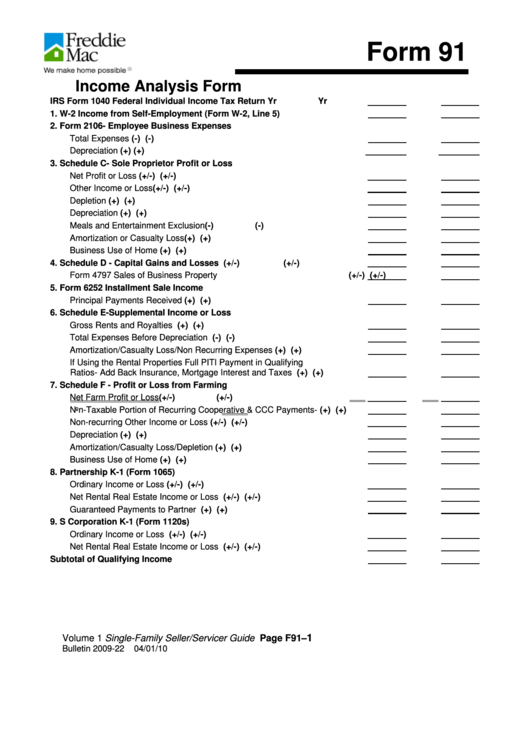

Form 91

Income Analysis Form

IRS Form 1040 Federal Individual Income Tax Return

Yr

Yr

1. W-2 Income from Self-Employment (Form W-2, Line 5)

2. Form 2106- Employee Business Expenses

Total Expenses

(-)

(-)

Depreciation

(+)

(+)

3. Schedule C- Sole Proprietor Profit or Loss

Net Profit or Loss

(+/-)

(+/-)

Other Income or Loss

(+/-)

(+/-)

Depletion

(+)

(+)

Depreciation

(+)

(+)

Meals and Entertainment Exclusion

(-)

(-)

Amortization or Casualty Loss

(+)

(+)

Business Use of Home

(+)

(+)

4. Schedule D - Capital Gains and Losses

(+/-)

(+/-)

Form 4797 Sales of Business Property

(+/-)

(+/-)

5. Form 6252 Installment Sale Income

Principal Payments Received

(+)

(+)

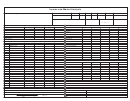

6. Schedule E-Supplemental Income or Loss

Gross Rents and Royalties

(+)

(+)

Total Expenses Before Depreciation

(-)

(-)

Amortization/Casualty Loss/Non Recurring Expenses

(+)

(+)

If Using the Rental Properties Full PITI Payment in Qualifying

Ratios- Add Back Insurance, Mortgage Interest and Taxes

(+)

(+)

7. Schedule F - Profit or Loss from Farming

Net Farm Profit or Loss

(+/-)

(+/-)

Non-Taxable Portion of Recurring Cooperative & CCC Payments-

(+)

(+)

Non-recurring Other Income or Loss

(+/-)

(+/-)

Depreciation

(+)

(+)

Amortization/Casualty Loss/Depletion

(+)

(+)

Business Use of Home

(+)

(+)

8. Partnership K-1 (Form 1065)

Ordinary Income or Loss

(+/-)

(+/-)

Net Rental Real Estate Income or Loss

(+/-)

(+/-)

Guaranteed Payments to Partner

(+)

(+)

9. S Corporation K-1 (Form 1120s)

Ordinary Income or Loss

(+/-)

(+/-)

Net Rental Real Estate Income or Loss

(+/-)

(+/-)

Subtotal of Qualifying Income

1

Volume 1

Single-Family Seller/Servicer Guide

Page F91–

Bulletin 2009-22

04/01/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3