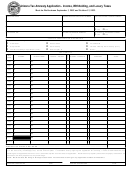

Form 91 - Income Analysis Form Page 3

Download a blank fillable Form 91 - Income Analysis Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 91 - Income Analysis Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Income Analysis Form Instructions

This form is not intended to replace a full analysis of acceptable income qualification and sources. This

form is intended to be used as a tool to help calculate income from self-employed sources. While this

form is most useful for self-employed Borrowers, it may also be used for Borrower’s who earn commission

income, are employed by a family member, property seller or broker or a Borrower who owns investment

properties. A separate form should be used for each Borrower. Income from the following sources should

be reviewed to ensure that it meets Guide requirements, and should be evaluated and documented

separately: W-2 income that is not from self-employment, interest and dividend income, alimony, trust,

pension or IRA, unemployment and social security. See Guide Chapter 37 for additional information on

evaluating the Borrower’s qualifying income.

Line 1- W-2 income: If evaluating a self-employed Borrower, only include the W-2 income from self-

employment on this line. W-2 income from other sources should be evaluated separately.

Line 2- Form 2106: Deduct all employee paid business expenses. Add back depreciation, if applicable.

Line 3- Schedule C income: Include continuing income or loss from commission or sole proprietorship in

this area.

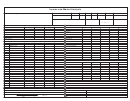

Line 4- Capital Gains and Losses: Only recurring gains and losses consistent over a two-year period

may be considered (one-time gains or losses should not be considered). There must be documentation to

support verification of sufficient assets remaining after closing to support, the income used to qualify, in

the Mortgage file.

Line 5- Form 6252- Installment Sale Income: Include this income if payments have been received for at

least one year. A copy of the installment sales agreement evidencing a minimum three-year continuance

must be retained in the Mortgage file.

Line 6- Schedule E- Supplemental Income or Loss: Use this area to calculate continuing rent and

royalty income (income from a Partnership or S-Corporation is added to lines 8,9,10,11 and 12). Royalty

income may be used if there is a 12-month history of receipt and documentation that it will continue for a

minimum of three years. Rental properties should match the properties on the Schedule of Real Estate

Owned on the application (Form 65). If properties are reflected on the application but not on the tax

returns, provide alternative documentation as required by Guide Chapter 37. If properties are reflected on

the tax returns but not on the application, provide documentation to evidence proof of sale or transfer of

ownership.

Line 7- Schedule F- Profit or loss from Farming: Use the net farm income and add back allowances as

indicated. Add back the non-taxable portions of the Cooperative and CCC income only if it has been

proven to be recurring and stable. The subject property must not be listed as the address of the farm.

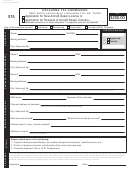

Line 8- Partnership K-1 income: Use of this income is only allowed if the Partnership tax returns (Form

1065) evidence that the partnership is showing positive earning trends and liquidity, the Borrower

provides a partnership resolution reflecting the Borrower’s access to the income and the income is not

already reported on the Borrower’s personal tax returns (Form 1040)

Line 9- S-Corporation K-1 income: Use of this income is only allowed if the S-Corporation tax returns

(Form 1120S) evidence that the S-Corporation is showing positive earning trends and liquidity, the

Borrower provides a corporate resolution proving access to the income and the income is not already

reported on the Borrower’s personal tax returns (Form 1040)

Line 10, 11 and 12- Partnership, S-Corporation and Corporation income: Use of the Borrower’s

share of after-tax Partnership, S-Corp and Corporate income is only allowed if the Borrowers’ percentage

of ownership and right to the funds has been documented in the Mortgage file and the business tax

returns reflect positive earning trends and liquidity. If the business operates on a fiscal year that is

different from the calendar year, adjustments must be made to relate the income to the Borrowers’ tax

return.

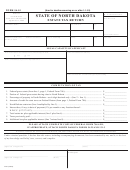

3

Volume 1

Single-Family Seller/Servicer Guide

Page F91–

Bulletin 2009-22

04/01/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3