Tax Return And Self Assessment For The Year 2015

ADVERTISEMENT

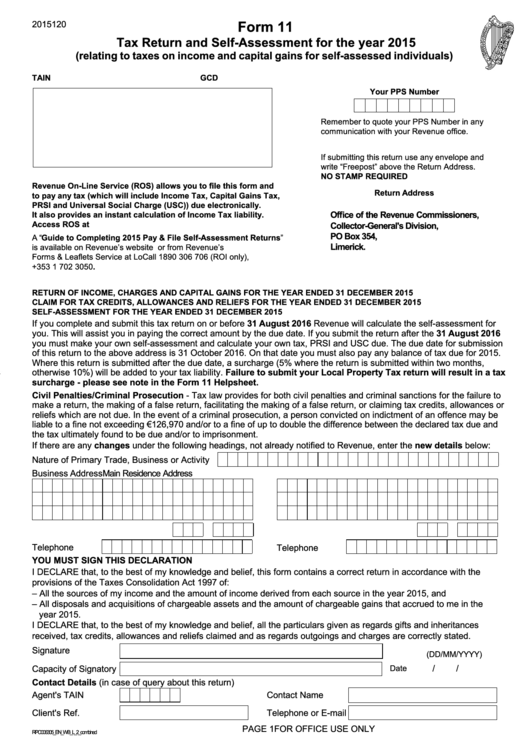

Form 11

2015120

Tax Return and Self-Assessment for the year 2015

(relating to taxes on income and capital gains for self-assessed individuals)

TAIN

GCD

Your PPS Number

Remember to quote your PPS Number in any

communication with your Revenue office.

If submitting this return use any envelope and

write “Freepost” above the Return Address.

NO STAMP REQUIRED

Revenue On-Line Service (ROS) allows you to file this form and

Return Address

to pay any tax (which will include Income Tax, Capital Gains Tax,

PRSI and Universal Social Charge (USC)) due electronically.

It also provides an instant calculation of Income Tax liability.

Office of the Revenue Commissioners,

Access ROS at

Collector-General's Division,

PO Box 354,

A “Guide to Completing 2015 Pay & File Self-Assessment Returns”

Limerick.

is available on Revenue’s website or from Revenue’s

Forms & Leaflets Service at LoCall 1890 306 706 (ROI only),

+353 1 702 3050.

RETURN OF INCOME, CHARGES AND CAPITAL GAINS FOR THE YEAR ENDED 31 DECEMBER 2015

CLAIM FOR TAX CREDITS, ALLOWANCES AND RELIEFS FOR THE YEAR ENDED 31 DECEMBER 2015

SELF-ASSESSMENT FOR THE YEAR ENDED 31 DECEMBER 2015

If you complete and submit this tax return on or before 31 August 2016 Revenue will calculate the self-assessment for

you. This will assist you in paying the correct amount by the due date. If you submit the return after the 31 August 2016

you must make your own self-assessment and calculate your own tax, PRSI and USC due. The due date for submission

of this return to the above address is 31 October 2016. On that date you must also pay any balance of tax due for 2015.

Where this return is submitted after the due date, a surcharge (5% where the return is submitted within two months,

otherwise 10%) will be added to your tax liability. Failure to submit your Local Property Tax return will result in a tax

surcharge - please see note in the Form 11 Helpsheet.

Civil Penalties/Criminal Prosecution - Tax law provides for both civil penalties and criminal sanctions for the failure to

make a return, the making of a false return, facilitating the making of a false return, or claiming tax credits, allowances or

reliefs which are not due. In the event of a criminal prosecution, a person convicted on indictment of an offence may be

liable to a fine not exceeding €126,970 and/or to a fine of up to double the difference between the declared tax due and

the tax ultimately found to be due and/or to imprisonment.

If there are any changes under the following headings, not already notified to Revenue, enter the new details below:

Nature of Primary Trade, Business or Activity

Business Address

Main Residence Address

Telephone

Telephone

YOU MUST SIGN THIS DECLARATION

I DECLARE that, to the best of my knowledge and belief, this form contains a correct return in accordance with the

provisions of the Taxes Consolidation Act 1997 of:

– All the sources of my income and the amount of income derived from each source in the year 2015, and

– All disposals and acquisitions of chargeable assets and the amount of chargeable gains that accrued to me in the

year 2015.

I DECLARE that, to the best of my knowledge and belief, all the particulars given as regards gifts and inheritances

received, tax credits, allowances and reliefs claimed and as regards outgoings and charges are correctly stated.

Signature

(DD/MM/YYYY)

/

/

Capacity of Signatory

Date

Contact Details (in case of query about this return)

Agent's TAIN

Contact Name

Client's Ref.

Telephone or E-mail

PAGE 1

FOR OFFICE USE ONLY

RPC006305_EN_WB_L_2_combi n ed

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36