Military Personnel Instructions - Utah Page 12

ADVERTISEMENT

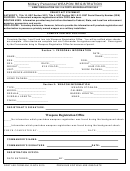

Income Tax Supplemental Schedule

TC-40A

Pg. 1

Nonresident Married Military

40604

2016

SSN

Last name

Service Member and Spouse

USTC ORIGINAL FORM

Part 1 - Additions to Income (write the code and amount of each addition to income)

Code

Amount

.00

Code

Code

•

51 Lump sum distributions

57 Municipal bond interest

.00

53 Medical Savings Account (MSA) addback*

60 Untaxed income of a resident trust

•

54 Utah Educational Savings Plan (UESP) addback*

61 Untaxed income of a nonresident trust

.00

56 Child’s income excluded from parent’s return

69 Equitable adjustments

•

* to the extent previously deducted or credited on Utah return

.00

•

.00

•

.00

Total additions to income (add all additions to income and enter total here and on TC-40, line 5)

Part 2 - Subtractions from Income (write the code and amount of each subtraction from income)

Code

Amount

82

24875

.00

Code

Code

•

71 Interest from U.S. Government Obligations

78 Railroad retirement income

88

15250

.00

77 Native American Income:

Tribe

79 Equitable adjustments

•

Enrollment Number

Code

82 Nonresident active duty military pay

.00

Yours

•

85 State tax refund distributed to beneficiary

•

Spouse’s

•

88 Nonresident military spouse income

.00

•

.00

•

40125

.00

Total subtractions from income (add all subtractions from income and enter total here and on TC-40, line 8)

Part 3 - Apportionable Nonrefundable Credits (write the code and amount of each credit)

Code

Amount

.00

Code

Code

•

04 Capital gain transactions credit

22 Medical Care Savings Account (MSA) credit

.00

18 Retirement tax credit (attach TC-40C)

23 Health benefit plan credit

•

20 Utah Educational Savings Plan (UESP) credit

24 Qualifying solar project credit

.00

26 Gold and silver coin sale credit

•

.00

•

.00

•

.00

Total apportionable nonrefundable credits (add all Part 3 credits and enter total here and on TC-40, line 24)

Part 4 - Nonapportionable Nonrefundable Credits (write the code and amount of each credit)

Code

Amount

.00

Code

Code

•

01 At-home parent credit

13 Carryforward of mach./equip. research credit

.00

02 Qualified sheltered workshop credit - name:

17 Tax paid to another state (attach TC-40S)

•

19 Live organ donation expenses credit

.00

05 Clean fuel vehicle credit

21 Renewable residential energy systems credit

•

06 Historic preservation credit

25 Combat related death credit

.00

07 Carryforward of enterprise zone credit

27 Veteran employment tax credit

•

08 Low-income housing credit

28 Employing persons who are homeless

.00

10 Recycling market dev. zone credit

63 Achieving a Better Life Experience Prog. credit

•

12 Research activities credit

.00

Total nonapportionable nonrefundable credits (add all Part 4 credits and enter total here and on TC-40, line 26)

Submit page ONLY if data entered.

Attach completed schedule to your Utah Income Tax Return.

57

page 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14