Military Personnel Instructions - Utah Page 8

ADVERTISEMENT

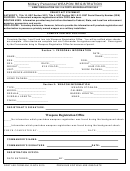

Utah State Tax Commission

2016

40601

Utah Individual Income Tax Return

TC-40

All State Income Tax Dollars Fund Education

9998

• Amended Return - enter code:

(code 1 - 5 from instructions)

USTC ORIGINAL FORM

Your Social Security No.

Your first name

Your last name

If deceased,

Example for a

complete

Spouse’s Soc. Sec. No.

Spouse’s first name

Spouse's last name

page 3,

Nonresident Single

Part 1

Address

Telephone number

Military Service Member

City

State

ZIP+4

Foreign country (if not U.S.)

1 Filing Status - enter code

• 2

Exemptions - enter number

3 Election Campaign Fund - enter code

1

1 = Single

a

Yourself*

Does not increase your tax or reduce your refund

1

•

2 = Married filing jointly

b

Spouse*

C = Constitution

3 = Married filing separately

c

Dependents*

D = Democratic

Yourself

Spouse

4 = Head of household

d

Dependents with a disability

M = Independent American •

•

1

5 = Qualifying widow(er)

e

Total exemptions (add a through d)

L = Libertarian

R = Republican

N = No contribution

* from federal return

If using code 2 or 3, enter spouse’s name and SSN above

33600

.00

4

Federal adjusted gross income from federal return

• 4

.00

5

Additions to income from TC-40A, Part 1 (attach TC-40A, page 1)

• 5

.00

6

Total income - add line 4 and line 5

6

.00

7

State tax refund included on federal form 1040, line 10, if any

• 7

18000

.00

8

Subtractions from income from TC-40A, Part 2 (attach TC-40A, page 1)

• 8

15600

.00

9

Utah taxable income (loss) - subtract the sum of lines 7 and 8 from line 6

• 9

780

.00

10 Utah tax - multiply line 9 by 5% (.05) (not less than zero)

• 10

3038

.00

11 Exemption amount - multiply line 2e by $3,038 (if line 4 over $155,650, see instr.) • 11

6300

Electronic filing

.00

12 Federal standard or itemized deductions

• 12

is quick, easy and

9338

free, and will

.00

13 Add line 11 and line 12

13

speed up your refund.

.00

14 State income tax deducted on federal Schedule A, line 5, if any

• 14

To learn more,

9338

go to

.00

15 Subtract line 14 from line 13

15

taxexpress.utah.gov

560

.00

16 Initial credit before phase-out - multiply line 15 by 6% (.06)

• 16

13867

.00

17 Enter: $13,867 (if single or married filing separately); $20,801 (if head

• 17

of household); or $27,734 (if married filing jointly or qualifying widower)

1733

.00

18 Income subject to phase-out - subtract line 17 from line 9 (not less than zero)

18

23

.00

19 Phase-out amount - multiply line 18 by 1.3% (.013)

• 19

537

.00

20 Taxpayer tax credit - subtract line 19 from line 16 (not less than zero)

• 20

21 If you are a qualified exempt taxpayer, enter “X” (complete worksheet in instr.)

• 21

243

.00

22 Utah income tax - subtract line 20 from line 10 (not less than zero)

• 22

57

page 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14