TO RETURN TO FORM CLICK HERE

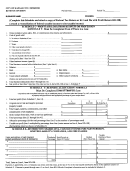

PA Schedule C

Profit or Loss from

Business or Profession

(Sole Proprietorship)

PA-40 C (08-15) (FI)

PA DEPARTMENT OF REVENUE

Line 4.

For each asset, you must also report straight-line depreciation,

Other income. Enter gross proceeds you may have

unless not using an optional accelerated depreciation method.

to report elsewhere on your federal tax return, including but

You need straight-line depreciation to take advantage of

not limited to:

Pennsylvania’s Tax Benefit Rule when you sell the asset. See

•

The sale of business assets when you reinvest the proceeds

the PA PIT Guide for the Tax Benefit Rule.

in business operations;

•

PA Law requires that taxpayers use straight-line depreciation

The gain (loss) on replacing business property, including land

if an asset’s basis for determining depreciation is different

or buildings used in operating your business or profession;

from its basis for federal income tax purposes.

and

•

Interest and dividend income from short-term investments

Line 13b. Section 179 expense.

PA PIT law limits IRC

to generate working capital.

Section 179 current expensing to the expensing allowed at the

time you placed the asset into service or in effect under the

Submit a statement explaining the amount you enter. See the

IRC of 1986 as amended to Jan. 1, 1997. The maximum

PA PIT Guide for an explanation of allocable interest, dividends

deduction that PA Income Tax law permits under IRC Section

and gains to business or professions. Include other income you

179 is $25,000. Pennsylvania follows the federal definitions for

enter on Line 6, Federal Schedule C, but not refunds of federal

listed property.

taxes and credits you did not deduct for PA purposes.

Line 14.

Dues and publications. You may deduct dues and

Part II.

Deductions

publications, but only to the extent directly used for ordinary

Use generally accepted accounting principles and practices to

business purposes. You must exclude any personal use of such

maintain your books and records and report your expenses

expenses.

from your business or professional activity. PA law does not

impose dollar or percentage limitations on allowable expenses.

Line 15.

Employee benefit programs other than on Line

You may deduct 100 percent of the PA allowable business or

23. You may not deduct any payments you make for your own

professional expenses incurred during the taxable year.

personal coverage. Pennsylvania does not allow any personal

expenses on any PA tax return.

NOTE:

You may have incurred other expenses for entertainment

facilities (boat, resort, ranch, etc.), living accommodations

Line 17.

Insurance. You may deduct life insurance on

(except for employees on business) or vacations for yourself,

yourself or your spouse only if the business is the beneficiary

your employees or their families. Reduce your total business

(not your spouse, other family members or other persons).

expenses in Part II by the total of these personal expenses.

The business must use the insurance proceeds to continue

business operations. If deducting insurance premiums, the

Generally, you may usually use your Federal Schedule C

proceeds are business income on Line 4 of Part I.

expenses for PA PIT purposes. See the other Pennsylvania and

federal income tax differences explanation beginning on Page 1

Line 18.

Interest on business indebtedness. Deduct

of the instructions for more information.

interest on business debt only. If you personally borrow

money to acquire a business interest or to improve your

You may not use federal amounts after making certain elections

business, you may not deduct the interest on any PA schedule

to accelerate or defer expenses or spread expenses over more

or PA tax return.

than one taxable year. These instructions explain those expense

categories where PA PIT rules and federal rules differ.

Line 20.

Legal and professional services. Only deduct

those expenses you incur in operating your business or

Line 7.

Amortization. Pennsylvania generally follows federal

profession. You may not deduct any personal expenses. You

rules. You have the option to use any amortization method

may include business accounting and tax return preparation

allowable under generally accepted accounting principles and

expenses, but not the costs for personal accounting and tax

practices. Include the amortization of any start-up costs in

returns.

excess of $5,000 on this line. Do not include the amortization

Line 21.

of IDCs on this line.

Management fees. Include any management fees

paid in conjunction with the operation of the business to any

Line 10.

Car and truck expenses. You may deduct 100

related or non-related entity.

percent of your actual vehicle expenses or you may use the

Line 23.

federal standard mileage rate. If you use the federal standard

Pension and profit-sharing plans for employees.

mileage rate, you may not deduct any actual operating

Only deduct those expenses directly related to pension and

expenses, including depreciation and lease costs. Follow the

profit-sharing plans for employees. You may not deduct any

Federal Schedule C rules for these expenses. If you use your

pension or profit-sharing expenses for your own personal

car or truck for both business and personal travel, you may

retirement benefits.

only deduct the business portion of your expenses.

Line 25.

Rent on business property. Only deduct those

Line 13a.

Regular depreciation. Use any depreciation method

expenditures you incurred in the operation of your business or

permissible under generally accepted accounting principles

profession.

and practices as long as you consistently apply the method.

Line 27.

Subcontractor fees. Deduct subcontractor fees

NOTE:

PA PIT law does not permit the bonus depreciation

that were not included in your calculation of cost of labor from

Line 3 of Schedule C-1. Also include any fees paid to payees

elections added to the Internal Revenue Code in 2002, 2003,

not included as employees to whom regular wages were paid.

2008 and 2009.

PAGE 3

NEXT PAGE

1

1 2

2 3

3 4

4 5

5 6

6