Verification Worksheet Template 2014-15

ADVERTISEMENT

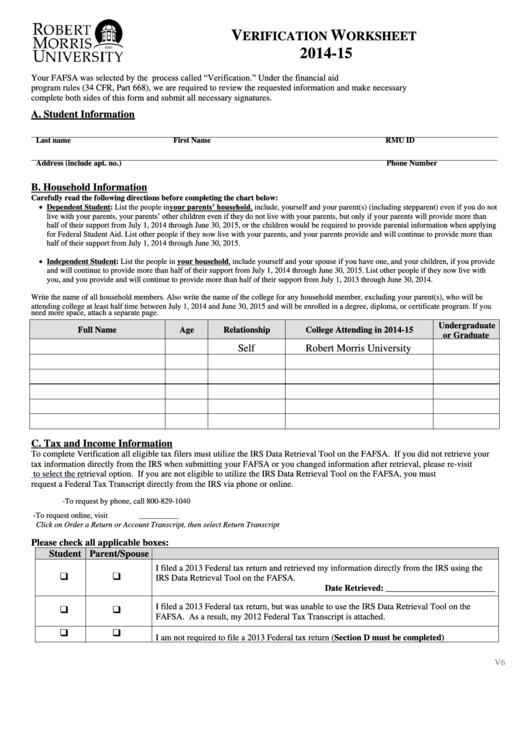

V

W

ERIFICATION

ORKSHEET

2014-15

Your FAFSA was selected by the U.S. Department of Education for a review process called “Verification.” Under the financial aid

program rules (34 CFR, Part 668), we are required to review the requested information and make necessary corrections. Please

complete both sides of this form and submit all necessary signatures.

A. Student Information

Last name

First Name

RMU ID

M.I.

Address (include apt. no.)

Phone Number

B. Household Information

Carefully read the following directions before completing the chart below:

Dependent Student: List the people in your parents’ household, include, yourself and your parent(s) (including stepparent) even if you do not

live with your parents, your parents’ other children even if they do not live with your parents, but only if your parents will provide more than

half of their support from July 1, 2014 through June 30, 2015, or the children would be required to provide parental information when applying

for Federal Student Aid. List other people if they now live with your parents, and your parents provide and will continue to provide more than

half of their support from July 1, 2014 through June 30, 2015.

Independent Student: List the people in your household, include yourself and your spouse if you have one, and your children, if you provide

and will continue to provide more than half of their support from July 1, 2014 through June 30, 2015. List other people if they now live with

you, and you provide and will continue to provide more than half of their support from July 1, 2013 through June 30, 2014.

Write the name of all household members. Also write the name of the college for any household member, excluding your parent(s), who will be

attending college at least half time between July 1, 2014 and June 30, 2015 and will be enrolled in a degree, diploma, or certificate program. If you

need more space, attach a separate page.

Undergraduate

Full Name

Age

Relationship

College Attending in 2014-15

or Graduate

Degree

Self

Robert Morris University

C. Tax and Income Information

To complete Verification all eligible tax filers must utilize the IRS Data Retrieval Tool on the FAFSA. If you did not retrieve your

tax information directly from the IRS when submitting your FAFSA or you changed information after retrieval, please re-visit

to select the retrieval option. If you are not eligible to utilize the IRS Data Retrieval Tool on the FAFSA, you must

request a Federal Tax Transcript directly from the IRS via phone or online.

-To request by phone, call 800-829-1040

-To request online, visit

Click on Order a Return or Account Transcript, then select Return Transcript

Please check all applicable boxes:

Student Parent/Spouse

I filed a 2013 Federal tax return and retrieved my information directly from the IRS using the

❑

❑

IRS Data Retrieval Tool on the FAFSA.

Date Retrieved: _________________________

I filed a 2013 Federal tax return, but was unable to use the IRS Data Retrieval Tool on the

❑

❑

FAFSA. As a result, my 2012 Federal Tax Transcript is attached.

❑

❑

I am not required to file a 2013 Federal tax return (Section D must be completed)

V6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2