COUNTY OF RIVERSIDE TREASURER-TAX COLLECTOR

th

4080 LEMON STREET 4

FLOOR / P.O. BOX 12005

ATTN: MOBILEHOMES

RIVERSIDE, CA 92502

PHONE: 951-955-3900

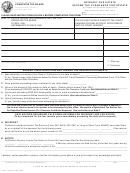

INFORMATION ON HOW TO OBTAIN MOBILEHOME TAX CLEARANCE CERTIFICATES

If a mobilehome was purchased new after June 30, 1980, or if the payment of annual license fee renewals on a

mobilehome are delinquent more than 120 days (except delinquencies which begin after May 31, 1984), a Tax Clearance

Certificate is required to be issued by the County Tax Collector prior to transfer of title through California’s Housing and

Community Development Department.

To issue a Tax Clearance, the County Tax Collector requires that the form on the reverse side be completed and

accompanied by either:

1. A copy of the title search from Housing and Community Development

2. A copy of the pink slip

3. A copy of the last registration certificate on the mobilehome

4. If due to death, bring or mail a copy of the death certificate

If you do not have the required information, please contact the Department of Housing and Community Development at

3737 Main St., # 400, Riverside, CA 92501. You may also contact the Department of Housing and Community

Development at 800-952-8356.

Following receipt of this information, the Tax Collector performs a search of the tax rolls to verify that mobilehome

assessments exist for each applicable tax year following the date the mobilehome was originally entered on the County’s

tax rolls. Should an assessment for any tax year not be on the tax roll, escaped assessments for those years may be

collected, as directed by the County Assessor’s office. An escaped assessment is the result of an appraisable event that

has not been reported to the County Assessor’s office. Upon discovery, the property is reappraised to market value as of

the date of the assessable event.

st

The owner of record on the lien date of January 1

becomes responsible for the taxes for the following fiscal year.

st

Mobilehome estimates will be collected for the upcoming fiscal year beginning December 1

of each year until October

of the following year in order to ensure those taxes are paid and a lien is not recorded under the previous owner’s

name.

Due to the high volume of requests, processing can take from one to four weeks to complete. However, under certain

circumstances, additional documents such as a moving permit or bill of lading may be required. Accordingly, a letter will

be mailed to you requesting the necessary documentation.

Upon completion of your request, the Tax Collector will mail you a notice of the amount due and will, following receipt

of payment, promptly issue the Tax Clearance Certificate. Payment must be made by MONEY ORDER, CASHIER’S CHECK

th

or ESCROW CHECK. Cash payments are accepted only at the main office located at 4080 Lemon St., 4

Fl., Riverside, CA

92501. Please be advised payments made by personal check will result in a 30 day waiting period before our office is

able to issue the Tax Clearance Certificate.

As you can see a number of steps are involved in finalizing this transaction. We ask and do appreciate your assistance

and understanding. Tax Clearance Certificates will not be completed on a walk in basis, but are logged in and completed

in the order received.

A fee will be charged for duplicate requests of a Mobilehome Tax Clearance. To contact the Tax Collector’s office

concerning this matter, please telephone at 951-955-3900.

1

1 2

2