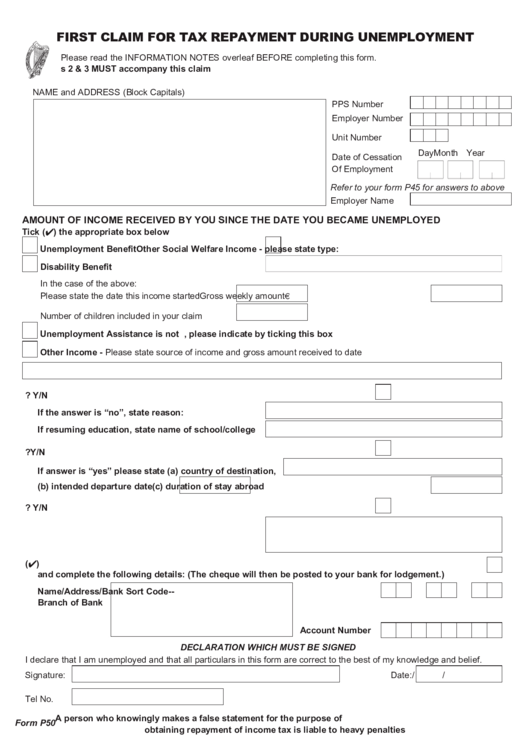

FIRST CLAIM FOR TAX REPAYMENT DURING UNEMPLOYMENT

Please read the INFORMATION NOTES overleaf BEFORE completing this form.

N.B. Form P45 Parts 2 & 3 MUST accompany this claim

NAME and ADDRESS (Block Capitals)

PPS Number

Employer Number

Unit Number

Day

Month Year

Date of Cessation

Of Employment

Refer to your form P45 for answers to above

Employer Name

AMOUNT OF INCOME RECEIVED BY YOU SINCE THE DATE YOU BECAME UNEMPLOYED

Tick (4) the appropriate box below

Unemployment Benefit

Other Social Welfare Income - please state type:

Disability Benefit

In the case of the above:

£

Please state the date this income started

Gross weekly amount

Number of children included in your claim

Unemployment Assistance is not taxable. If you are in receipt of U/A, please indicate by ticking this box

Other Income - Please state source of income and gross amount received to date

1. Do you intend to resume employment in Ireland before 31 December next? Y/N

If the answer is “no”, state reason:

If resuming education, state name of school/college

2. Are you making this claim on the basis that you are going abroad ? Y/N

If answer is “yes” please state (a) country of destination,

(b) intended departure date

(c) duration of stay abroad

3. Do you intend to take up employment abroad? Y/N

4. Address abroad for correspondence

5. If you wish to have any repayment that may be due to you lodged to your Bank Account please tick (4)

and complete the following details: (The cheque will then be posted to your bank for lodgement.)

Name/Address/

Bank Sort Code

-

-

Branch of Bank

Account Number

DECLARATION WHICH MUST BE SIGNED

I declare that I am unemployed and that all particulars in this form are correct to the best of my knowledge and belief.

Signature:

Date:

/

/

Tel No.

A person who knowingly makes a false statement for the purpose of

Form P50

obtaining repayment of income tax is liable to heavy penalties

1

1 2

2