Monthly Living Expenses Page 2

ADVERTISEMENT

a. Kids, unfortunately, tend to outgrow clothing faster than they wear it out. Try to estimate how

much you spend in a year on clothes - say, 2 pairs of shoes, a pair of jeans, a shirt, a new coat

every 2 years. Then, spread this amount over 12 months and put some aside each month.

b. Medical expenses: This would be those expenses not covered by insurance. If you have no

dental insurance, two in the household, and figure you should see the dentist twice a year for a

check-up and cleaning guess what it would take and spread that amount over 12 months. (2

people x 2 visits x $50/visit = $200 per year or about $17 per month to be set aside.) Another

item to include is the deductible or co-pay portion of your medical insurance.

c. Vehicle repair: Unless you are incredibly lucky, you need to change the oil in the car every once

in a while; the tires will wear out and the muffler will eventually fall off. Let's plan ahead, and

put money back in anticipation of these expenses.

d. Gifts: No mater what, birthdays, anniversaries and holidays come all too often. Even if you are a

card and small gift giver, plan ahead for these expenses.

e. Short term savings: This might cover emergency funds (like the refrigerator just died and we

have to fix or replace it) or vacations or a simple 'slush fund' of readily available money.

f. Long term savings: Think of this as paying yourself. Put money here for long range goals -

retirement, down payment on a home, a new car, school. This is where you really look to the

future.

7. What do you do with the money set aside for non-monthly expenses, or in anticipation? That's up to

you, but I suggest a savings account that is hard to get to, like the bank at the other end of town, or

your credit union. This way you won't be so tempted to "raid the till" except for its intended

purposes. Perhaps this money can be withheld from your pay and sent directly to your savings

account each payday. Whatever you do, be sure to include these items in your budget and put money

aside for them! Not doing so can throw all of your careful figuring totally out of balance.

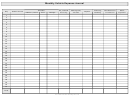

8. To use the attached budget worksheets follow these simple steps:

a. Determine the paydays for the month, and how much you anticipate receiving each time. Enter

this information in the appropriate spots at the top of the form.

b. Next, beside each suggested expense area fill in your budgeted amount. If there is a due date

involved, write it in.

c. Distribute expenses for the month under the appropriate column, taking into account expected

income and other expenses for that pay period as well as due dates. Bills should be budgeted for

payment on or before the due date. For this reason, you might consider making your budget

month start with the last pay period of the month instead of the first pay period (most rent and

house payments are due on the first of the month.) If there is not enough money in a pay period

to pay a given bill you may have to use two periods to cover the expense.

Budgeting is unique to each and every person. What works for me may not work for you. The

important thing is that you gain an understanding of what a budget is, and what a budget can do for you.

How you implement a household budget will become a matter of personal choice. Remember that a

successful budget is one that you interact with, and continually update - it only takes a few minutes each

week to make a budget work.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4