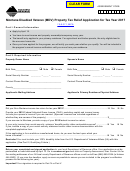

Part III. Qualifying Criteria

A reduced property tax rate is available for 100% disabled veterans and the unmarried surviving spouse who qualify. You

must own or currently be under contract to purchase a home or mobile/manufactured home and live in the home as your

primary residence for at least seven months of the year.

Important: You must provide a letter from the U.S. Department of Veterans Affairs (VA) with this application verifying

that you are currently rated or paid at the 100% disabled rate for a service-connected disability. If your disability rating

is temporary, will periodically ask you to provide an updated verification letter from the VA. The VA cannot give your

information directly to us. Surviving spouses must provide letters from the VA verifying that their deceased spouses were

rated or paid at the 100% disabled rate at the time of their death or died while on active duty or as the result of a service-

connected disability.

For tax year 2017, the income guidelines are: A single applicant’s Federal Adjusted Gross Income (FAGI), excluding

capital and income losses, must be less than $49,157 and head of household and married applicants’ FAGI must be less

than $56,720. Spouses’ incomes are included regardless of whether they are owners of the property. Unmarried surviving

spouses’ FAGI must be less than $42,855.

You only need to report your income one time. In future years, we will determine your eligibility through our annual

verification process.

Part IV. Affirmation and Signature of Montana Disabled Veteran

I affirm that I have been honorably discharged from active service in the armed forces, and I am currently rated 100%

disabled or paid at the 100% disabled rate because of a service-connected disability.

Under penalty of law, I/we affirm that I/we are owners of the property on which we are applying for the property tax benefit,

that I/we occupied the property as my/our primary residence for at least seven months of a calendar year and that the

information provided in this application form is true and correct.

X Property Owner Signature ____________________________________________ Date ________________________

X Property Owner’s Spouse Signature ____________________________________ Date ________________________

X Signature of Person Completing this Form

(if other than applicant) _______________________________________________ Date ________________________

Printed Name ________________________________________________________ Phone ______________________

Relationship to Applicant ___________________Email or Other Contact Information _____________________________

Part V. Affirmation and Signature of Surviving Spouse of Montana Disabled Veteran

I affirm that I am the surviving spouse of a veteran who was rated 100% disabled or paid at the 100% disabled rate as

a result of a service-connected disability at the time of death, died while on active duty, or died as a result of a service-

connected disability, and I have remained unmarried.

Under penalty of law, I affirm that I am the owner of the property on which I am applying for the property tax benefit, that

I occupied the property as my primary residence for at least seven months of a calendar year and that the information

provided in this application form is true and correct.

X Property Owner Signature ____________________________________________ Date ________________________

X Signature of Person Completing this Form

(if other than applicant) _______________________________________________ Date ________________________

Printed Name ________________________________________________________ Phone ______________________

Relationship to Applicant ___________________Email or Other Contact Information _____________________________

Please let us know how you heard about the Montana Disabled Veteran Property Tax Relief Program (MDV).

________________________________________________________________________________________________

Questions or Need Help? Please call us toll free at (866) 859-2254 (in Helena, 444-6900) or visit our website

at revenue.mt.gov.

1

1 2

2