Rental Adu Income Certification Form

ADVERTISEMENT

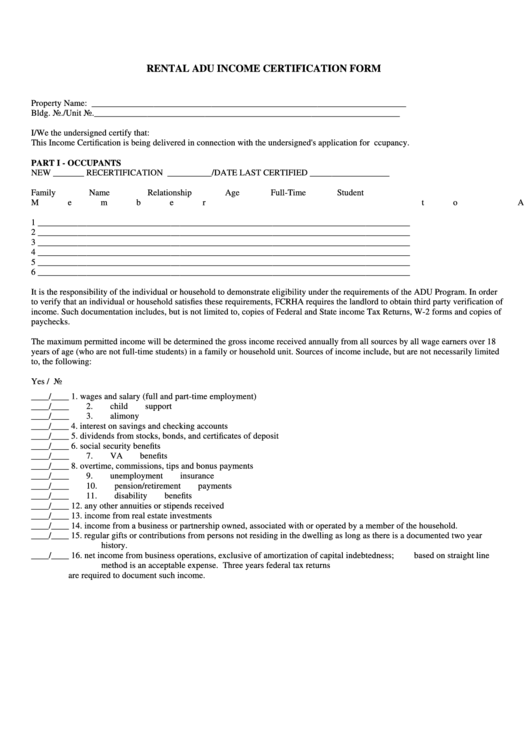

RENTAL ADU INCOME CERTIFICATION FORM

Property Name: _______________________________________________________________________

Bldg. No./Unit No._____________________________________________________________________

I/We the undersigned certify that:

This Income Certification is being delivered in connection with the undersigned's application for ccupancy.

PART I - OCCUPANTS

NEW

_______ RECERTIFICATION __________/DATE LAST CERTIFIED __________________

Family

Name

Relationship

Age

Full-Time Student

Member

to Applicant

(Yes or No)

1 ____________________________________________________________________________________

2 ____________________________________________________________________________________

3 ____________________________________________________________________________________

4 ____________________________________________________________________________________

5 ____________________________________________________________________________________

6 ____________________________________________________________________________________

It is the responsibility of the individual or household to demonstrate eligibility under the requirements of the ADU Program. In order

to verify that an individual or household satisfies these requirements, FCRHA requires the landlord to obtain third party verification of

income. Such documentation includes, but is not limited to, copies of Federal and State income Tax Returns, W-2 forms and copies of

paychecks.

The maximum permitted income will be determined the gross income received annually from all sources by all wage earners over 18

years of age (who are not full-time students) in a family or household unit. Sources of income include, but are not necessarily limited

to, the following:

Yes / No

____/____

1.

wages and salary (full and part-time employment)

____/____

2.

child support

____/____

3.

alimony

____/____

4.

interest on savings and checking accounts

____/____

5.

dividends from stocks, bonds, and certificates of deposit

____/____

6.

social security benefits

____/____

7.

VA benefits

____/____

8.

overtime, commissions, tips and bonus payments

____/____

9.

unemployment insurance

____/____

10. pension/retirement payments

____/____

11. disability benefits

____/____

12. any other annuities or stipends received

____/____

13. income from real estate investments

____/____

14. income from a business or partnership owned, associated with or operated by a member of the household.

____/____

15. regular gifts or contributions from persons not residing in the dwelling as long as there is a documented two year

history.

____/____

16. net income from business operations, exclusive of amortization of capital indebtedness;

based on straight line

method is an acceptable expense. Three years federal tax returns

are required to document such income.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2