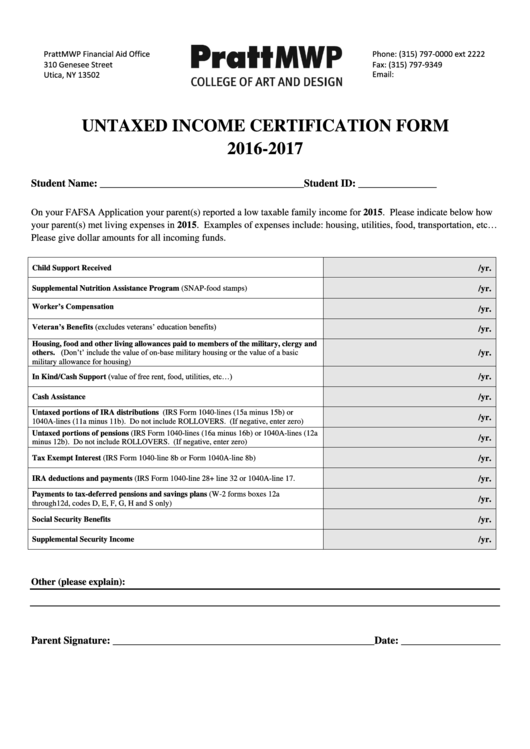

PrattMWP Financial Aid Office

Phone: (315) 797-0000 ext 2222

310 Genesee Street

Fax: (315) 797-9349

Utica, NY 13502

Email: finaid@mwpai.edu

UNTAXED INCOME CERTIFICATION FORM

2016-2017

Student Name: _______________________________________Student ID: _______________

On your FAFSA Application your parent(s) reported a low taxable family income for 2015. Please indicate below how

your parent(s) met living expenses in 2015. Examples of expenses include: housing, utilities, food, transportation, etc…

Please give dollar amounts for all incoming funds.

/yr.

Child Support Received

Supplemental Nutrition Assistance Program (SNAP-food stamps)

/yr.

Worker’s Compensation

/yr.

Veteran’s Benefits (excludes veterans’ education benefits)

/yr.

Housing, food and other living allowances paid to members of the military, clergy and

others. (Don’t’ include the value of on-base military housing or the value of a basic

/yr.

military allowance for housing)

In Kind/Cash Support (value of free rent, food, utilities, etc…)

/yr.

Cash Assistance

/yr.

Untaxed portions of IRA distributions (IRS Form 1040-lines (15a minus 15b) or

/yr.

1040A-lines (11a minus 11b). Do not include ROLLOVERS. (If negative, enter zero)

Untaxed portions of pensions (IRS Form 1040-lines (16a minus 16b) or 1040A-lines (12a

/yr.

minus 12b). Do not include ROLLOVERS. (If negative, enter zero)

/yr.

Tax Exempt Interest (IRS Form 1040-line 8b or Form 1040A-line 8b)

IRA deductions and payments (IRS Form 1040-line 28+ line 32 or 1040A-line 17.

/yr.

Payments to tax-deferred pensions and savings plans (W-2 forms boxes 12a

/yr.

through12d, codes D, E, F, G, H and S only)

/yr.

Social Security Benefits

Supplemental Security Income

/yr.

Other (please explain):

Parent Signature: __________________________________________________Date: ___________________

1

1