Page 2 of 7

IT-2104 (2017)

• You have been advised by the Internal Revenue Service that you

total number of allowances that you compute on line 17 and line 28 (if

are entitled to fewer allowances than claimed on your original federal

applicable) between you and your working spouse.

Form W-4, and the disallowed allowances were claimed on your

• $107,650 or more, use the chart(s) in Part 4 and enter the additional

original Form IT-2104.

withholding dollar amount on line 3.

Taxpayers with more than one job – If you have more than one job,

Exemption from withholding

file a separate IT-2104 certificate with each of your employers. Be

You cannot use Form IT-2104 to claim exemption from withholding.

sure to claim only the total number of allowances that you are entitled

To claim exemption from income tax withholding, you must file

to. Your withholding will better match your total tax if you claim all of

Form IT-2104-E, Certificate of Exemption from Withholding, with your

your allowances at your higher-paying job and zero allowances at

employer. You must file a new certificate each year that you qualify for

the lower-paying job. In addition, to make sure that you have enough

exemption. This exemption from withholding is allowable only if you had

tax withheld, if you are a single taxpayer or head of household with

no New York income tax liability in the prior year, you expect none in the

two or more jobs, and your combined wages from all jobs are under

current year, and you are over 65 years of age, under 18, or a full-time

$107,650, reduce the number of allowances by seven on line 1 and

student under 25. You may also claim exemption from withholding if

line 2 (if applicable) on the certificate you file with your higher-paying

you are a military spouse and meet the conditions set forth under the

job employer. If you arrive at negative allowances (less than zero), see

Servicemembers Civil Relief Act as amended by the Military Spouses

Withholding allowances above.

Residency Relief Act. If you are a dependent who is under 18 or a

If you are a single or a head of household taxpayer, and your combined

full-time student, you may owe tax if your income is more than $3,100.

wages from all of your jobs are between $107,650 and $2,263,265, use

the chart(s) in Part 5 and enter the additional withholding dollar amount

Withholding allowances

from the chart on line 3.

You may not claim a withholding allowance for yourself or, if married,

your spouse. Claim the number of withholding allowances you compute

If you are a married taxpayer, and your combined wages from all of

in Part 1 and Part 3 on page 3 of this form. If you want more tax

your jobs are $107,650 or more, use the chart(s) in Part 4 and enter the

withheld, you may claim fewer allowances. If you claim more than

additional withholding dollar amount from the chart on line 3 (Substitute

14 allowances, your employer must send a copy of your Form IT-2104

the words Higher-paying job for Higher earner’s wages within the chart).

to the New York State Tax Department. You may then be asked to

Dependents – If you are a dependent of another taxpayer and expect

verify your allowances. If you arrive at negative allowances (less than

your income to exceed $3,100, you should reduce your withholding

zero) on lines 1 or 2 and your employer cannot accommodate negative

allowances by one for each $1,000 of income over $2,500. This will

allowances, enter 0 and see Additional dollar amount(s) below.

ensure that your employer withholds enough tax.

Income from sources other than wages – If you have more than

Following the above instructions will help to ensure that you will not owe

$1,000 of income from sources other than wages (such as interest,

additional tax when you file your return.

dividends, or alimony received), reduce the number of allowances

claimed on line 1 and line 2 (if applicable) of the IT-2104 certificate by one

Heads of households with only one job – If you will use the

for each $1,000 of nonwage income. If you arrive at negative allowances

head-of-household filing status on your state income tax return, mark

(less than zero), see Withholding allowances above. You may also

the Single or Head of household box on the front of the certificate. If you

consider filing estimated tax, especially if you have significant amounts

have only one job, you may also wish to claim two additional withholding

of nonwage income. Estimated tax requires that payments be made by

allowances on line 14.

the employee directly to the Tax Department on a quarterly basis. For

more information, see the instructions for Form IT-2105, Estimated Tax

Additional dollar amount(s)

Payment Voucher for Individuals, or see Need help? on page 6.

You may ask your employer to withhold an additional dollar amount each

Other credits (Worksheet line 13) – If you will be eligible to claim

pay period by completing lines 3, 4, and 5 on Form IT-2104. In most

any credits other than the credits listed in the worksheet, such as an

instances, if you compute a negative number of allowances and your

investment tax credit, you may claim additional allowances.

employer cannot accommodate a negative number, for each negative

allowance claimed you should have an additional $1.85 of tax withheld per

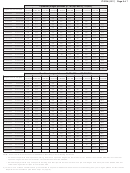

Find your filing status and your New York adjusted gross income (NYAGI)

week for New York State withholding on line 3, and an additional $0.80

in the chart below, and divide the amount of the expected credit by the

of tax withheld per week for New York City withholding on line 4. Yonkers

number indicated. Enter the result (rounded to the nearest whole number)

residents should use 16.75% (.1675) of the New York State amount for

on line 13.

additional withholding for Yonkers on line 5.

Note: If you are requesting your employer to withhold an additional dollar

Single and

Head of household

Married

Divide amount of

amount on lines 3, 4, or 5 of this allowance certificate, the additional

NYAGI is:

and NYAGI is:

and NYAGI is:

expected credit by:

dollar amount, as determined by these instructions or by using the

Less than

Less than

Less than

chart(s) in Part 4 or Part 5, is accurate for a weekly payroll. Therefore,

66

$215,400

$269,300

$323,200

if you are not paid on a weekly basis, you will need to adjust the dollar

Between

Between

Between

amount(s) that you compute. For example, if you are paid biweekly, you

$215,400 and $269,300 and

$323,200 and

68

must double the dollar amount(s) computed.

$1,077,550

$1,616,450

$2,155,350

Avoid underwithholding

Over

Over

Over

88

$1,077,550

$1,616,450

$2,155,350

Form IT-2104, together with your employer’s withholding tables, is

designed to ensure that the correct amount of tax is withheld from your pay.

Example: You are married and expect your New York adjusted gross

If you fail to have enough tax withheld during the entire year, you may owe

income to be less than $323,200. In addition, you expect to receive a

a large tax liability when you file your return. The Tax Department must

flow-through of an investment tax credit from the S corporation of which

assess interest and may impose penalties in certain situations in addition

you are a shareholder. The investment tax credit will be $160. Divide

to the tax liability. Even if you do not file a return, we may determine

the expected credit by 66. 160/66 = 2.4242. The additional withholding

that you owe personal income tax, and we may assess interest and

allowance(s) would be 2. Enter 2 on line 13.

penalties on the amount of tax that you should have paid during the year.

Married couples with both spouses working – If you and your spouse

both work, you should each file a separate IT-2104 certificate with your

(continued)

respective employers. Your withholding will better match your total tax if

the higher wage-earning spouse claims all of the couple’s allowances and

the lower wage-earning spouse claims zero allowances. Do not claim

more total allowances than you are entitled to. If your combined wages

are:

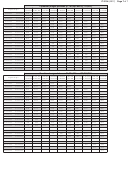

• less than $107,650, you should each mark an X in the box Married,

but withhold at higher single rate on the certificate front, and divide the

1

1 2

2 3

3 4

4 5

5 6

6 7

7